The CBRT let down analysts at its recent monetary policy meeting keeping the policy rate on hold at 17.75%. The analyst consensus, as well as market pricing, was for a 100 bps hike.

The Turkish central bank elucidated status quo decision by figuring out “a more significant rebalancing trend in economic activity” while signifying that “lagged impact of recent monetary policy decisions” and “contribution of fiscal policy” will help this rebalancing.

On the flips side, with this decision, CBRT failed to counteract the upside surprise in the June inflation print. Headline inflation jumped to 15.4% YoY in June from 12.2% YoY in May.

Geopolitical headwind: In the recent past, the US President Donald Trump announced "large sanctions" against Turkey yesterday via Twitter - in retaliation for the arrest of a US citizen. Well, the Turkish government has shown some flexibility (and sufficient influence on the judiciary) in similar cases in the past.

A solution to this dispute, therefore, seems possible. The fact that the Lira still dropped significantly may be due to the fact that it is already vulnerable after Tuesday's central bank decision. Every TRY-negative news flow has an intensified effect.

In such a situation, US sanctions - even temporary ones - would be dangerous. They would increase the risk of a spiral of TRY depreciation and capital flight.

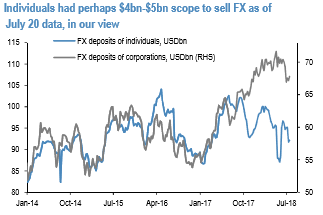

We believe the lira will sell-off further despite the muted reaction so far. The currency reacted negatively on the day but hasn’t sold off substantially yet. The retail sector still has some scope to sell FX but not large. We believe the retail sector had about $4bn$5bn scope to sell FX further as of data available up to July 20. We arrive at this figure by assuming individual investors can run down FX balances towards the low end of their recent range (refer 1st chart). However, some of this selling buffer was likely already used after the CBRT decision and hence it is again smaller now. Meanwhile, we do not assume any further scope for corporates to sell given that they currently hold only marginally more than their short-term FX liabilities.

NDF auctions now do not provide any further support to the currency and neither do rediscount credits. The NDF auction schedule now shows a flat profile for Q3 (refer 2nd chart), in line with CBRT signalling a $10bn cap for the program. This program provided about $2.4bn support to the market in June.

Meanwhile, CBRT allowing corporates to repay the rediscount credit program in lira provided up to $2n support to the FX market in both June and July (partially explaining the drop in FX reserves, refer 3rd chart). But the support from this program is now also ending. Courtesy: JPM

Currency Strength Index: FxWirePro's hourly USD spot index is flashing at -56 levels (which is bearish), while hourly EUR spot index was at 37 (mildly bullish) while articulating at (13:45 GMT). For more details on the index, please refer below weblink:

ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence

ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan

BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan  Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell

Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell  Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons

Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different