The FX volatility market has so far in 2019 failed to display any material inversion of the bearish trend started in mid- 2016. Most of the 0.7 vols rise in the J.P. Morgan VXY G7 Index since mid-July can be attributed to the Brexit risk premium impacting cable’s vol, whereas the EM Index, at present just 0.7 vols above the DM one, has continued a steady drop. A few weeks ago we had pointed out to synchronous dovish-sounding Central Banks as a key factor in keeping vol levels suppressed contemplating assessment of the impact of rates correlations on FX vols by JPM analysts. A less dovish than expected ECB yesterday is not dramatically altering this picture so far, at least on FX.

The short-Gamma/long-Vega trading theme, benefiting on the one hand from suppressed realized vols, and, from the other, from a possible rebound in vol levels, remains relevant for the present market conditions, at least over a multi-week horizon. The first topic will be analyzed by commenting on the performance of a filtering methodology applied to short 1M FX trades, which has kept on delivering a steady performance this year despite the suppressed vol levels.

The long-Vega theme will be specifically investigated from the perspective of long-dated vol ownership which, supported by positive carry in the underlying asset, can permit obtaining under certain conditions a positive time decay for the options premia. We then present some ideas on how to play a weaker EUR via L/S directional option structures.

FX short-Gamma strategies have delivered very solid performances over the past three years. While the strategic potential of selling assets trading near multi-year lows is questionable, from a purely tactical perspective, short-Gamma trades could nonetheless benefit from:

a) suppressed realized vols, implying b) positive (if not wide).

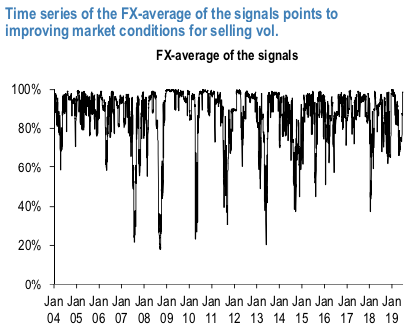

We introduced a tactical filter for timing FX short-Gamma trades (1M 25-delta strangles) in a recent piece (Timing FX short-vol strategies). EURUSD, USDCHF, USDMXN, and USDCNH are the sole four case where the latest trading signals by the model are below 100% (max short-vol capacity). As we can see from the above chart, the average signal for short-Gamma as recommended by the model has gradually increased from the late May lows, when trade wars and monetary policy uncertainties were weighing on vol premia, suggesting a more cautious stance. Courtesy: JPM

Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential