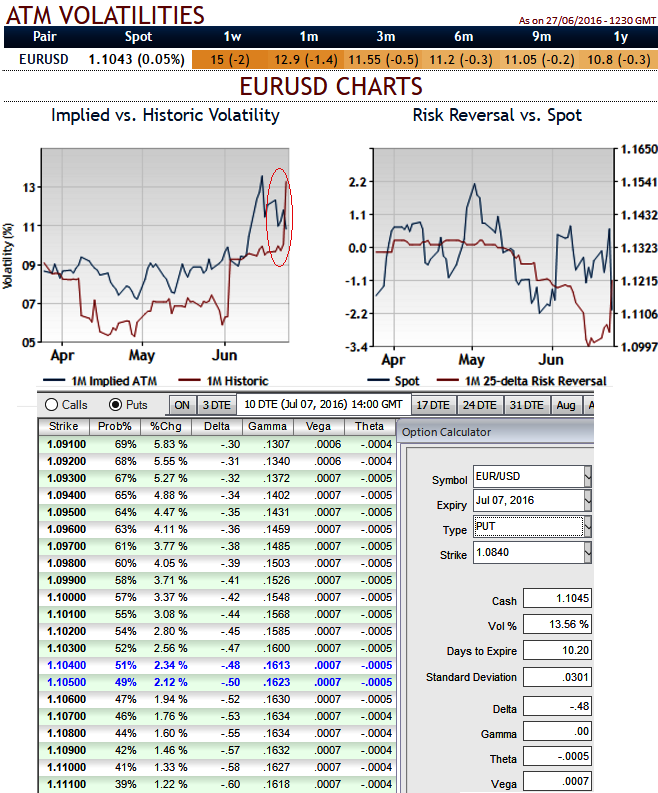

As you can observe from the above graph is evidencing the beginning of the divergence between historic vols and implied vols.

The ATM IVs across all tenors have been shrinking as a result of significant Brexit event is done and it is now all about competing with the time factor.

As the vega and theta are flashing higher numbers on OTM put strikes while comparing that with shrinking vols, it would be a perfect time for shorting overpriced options.

Thereby, the approach we like to adopt to take advantage by trading implied volatility is through shorting Vega on OTM stikes.

In particular, not only should the risk premium in the FX market fall, but the environment will not support the emergence of new trends.

Moreover, we expect EUR/USD to stay confined within the large 1.05-1.16 range holding since March 2015.

Volatility peaked during the euro fall that began in 2014, but though the range was relatively turbulent initially, EUR/USD realized volatility is now going down.

The market can’t keep buying volatility in a trendless market and with limited central banks shifts expected in the coming months.

Hence, the recommendation would be the buy on EUR/USD 6m double no touch, knock-out 1.05-1.16 Indicative offer: 15% (at spot ref: 1.1052)

Risks: Limited to the premium. Investors buying a double no-touch option cannot lose more than the premium initially invested. However, it will be knocked out if EUR/USD hits 1.05 or 1.16 at any time before the 6m expiry.

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data