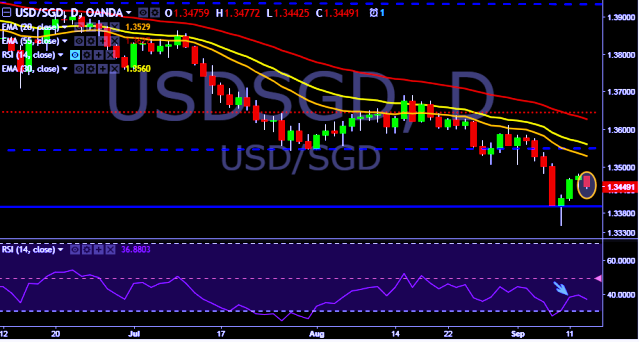

- USD/SGD is currently trading around 1.3448 marks.

- It made intraday high at 1.3477 and low at 1.3442 levels.

- Intraday bias remains bearish till the time pair holds key resistance at 1.3482 mark.

- A daily close above 1.3475 will test key resistances at 1.3509, 1.3622, 1.3788, 1.3822, 1.3949, 1.4046, 1.4095, 1.4128, 1.4219 and 1.4310 levels respectively.

- Alternatively, a consistent close below 1.3475 will drag the parity down towards key supports at 1.3436/1.3346/1.3217/1.3164/1.3005 levels respectively.

- Important to note here that 20D, 30D and 55D EMA heads down and confirms the bearish trend in a daily chart.

- Yesterday Singapore released retail sales data.

- Singapore July total retail sales +3.0 pct m/m.

- Singapore July total retail sales +1.8 pct y/y.

We prefer to take short position in USD/SGD around 1.3455, stop loss 1.3482 and target of 1.3396/1.3346.

FxWirePro launches Absolute Return Managed Program. For more details, visit http://www.fxwirepro.com/invest