- In our recent post, we’ve already stated that USDCAD has shown a good recovery after hitting low of 1.3260 on account of escalating the US and other economies trade war. But for now, scenarios seem to be turning around the table.

- WTI Crude oil prices have shown a huge recovery from the low of $64.49 to the current $73.50 levels after recent OPEC meeting and EIA inventory inspections. OPEC has announced that output is set to increase by 1MMbbls/d. It hits high of $71.45 and is currently trading around $71.38.

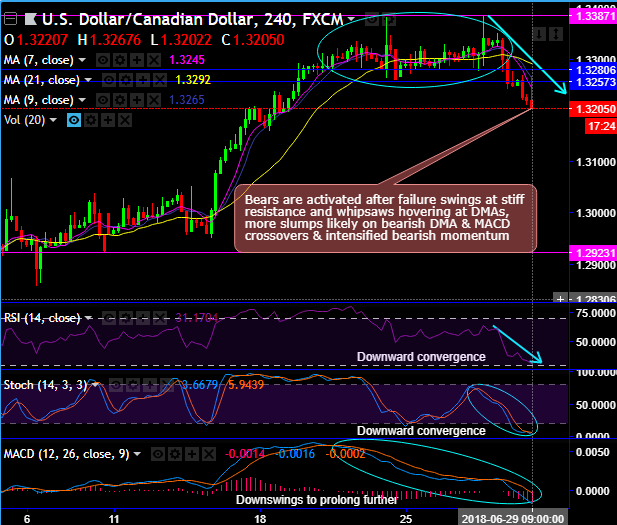

- Technically, near-term resistance is around 1.3280-1.3293 levels and one can expect upswings only upon any convincing break-out above these levels. But for now, the bears are activated after failure swings at stiff resistance of 1.3387 levels and the formation whipsaws pattern that has been hovering at DMAs, consequently, more slumps likely on bearish DMA & MACD crossovers & intensified bearish momentum (RSI & stochastic curves’ downward convergence, refer 4H chart). While the intermediate trend also seems edgy, the occurrence of back-to-back shooting star signal weakness, the momentum oscillators indicate Over Bought pressures, whereas, the trend indicators (EMAs and MACD) still signal bullish swings to prolong further. On the lower side, near-term support is around 1.3157 levels and any convincing break below will drag the pair down till 1.3085 (i.e. 7EMA or even upto 1.3130 levels).

- Trade tips: At spot reference: 1.3216 levels, it is wise to snap rallies and attain exponential yields via tunnel spreads using upper strikes at 1.3246 and lower strikes at around 1.3157.

Currency Strength Index: FxWirePro's hourly CAD spot index is flashing at 88 levels (which is bullish), while hourly USD spot index was at -12 (neutral) while articulating at (12:56 GMT). For more details on the index, please refer below weblink:

http://www.fxwirepro.com/currencyindex

FxWirePro launches Absolute Return Managed Program. For more details, visit:

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand