AUDNZD medium-term perspectives: Momentum is negative following some AU data disappointments. 1.0950 looks vulnerable.

A resumption of the trend rise which started in June should test 1.13, contingent on AU economic data remaining supportive, commodity prices recovering, risk sentiment remaining elevated, and NZ politics weighing on the NZD.

Trade DNT’s: Contemplating both short term and long term technical of AUDNZD, we recommended certain yields but a limited loss structure via double-no-touch optionality in next 1-month, AUDNZD 1m DNT with 1.1125/1.0803 strikes – we are reluctant to sell volatility outright given the unquantifiable risk. However, shorting volatility and fading the spike in skew through limited loss structures (i.e. DNT’s) could be appropriate.

AUDNZD major downtrend has been drifting in the consolidation phase and jerky in short run, drop to 1.0989 levels (recent lows).

We expect the 1.0809 areas which can’t be disregarded if iron ore remains under downward pressure. A retest of the 1.10 area seen in April is also possible if iron ore’s rally since mid-June continues and global risk sentiment remains elevated.

We’ve seen the bearish impact on underlying AUDNZD movement in the major trend. Technically, the price behavior has been weaker with both leading as well as lagging indicators are bearish bias.

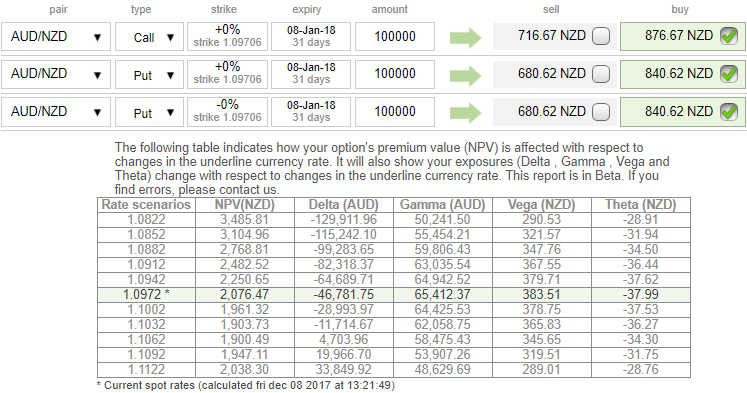

Contemplating above fundamental developments and the ongoing technical trend of this pair, to participate in the puzzling swings, we advocate option strips strategy that contains 3 legs of vega longs (2 puts plus 1 call). The option strips that likely to fetch desired yields regardless of the trend but more potential on southwards by arresting bearish risks.

As shown in the diagram, the execution goes this way: Initiate 2 lots of 1m longs in Vega put options, simultaneously, add 1 lot of Vega call options of the similar expiry, the strategy is executed at net debit.

Please be noted that the strategy is likely to derive positive cash flows regardless of the underlying spot FX moves with more potential on the downside.

Currency Strength Index: FxWirePro's hourly AUD spot index is flashing at -86 levels (which is bearish), while hourly NZD spot index was at shy above 86 (bullish) while articulating (at 07:46 GMT). For more details on the index, please refer below weblink:

http://www.fxwirepro.com/currencyindex.

FxWirePro launches Absolute Return Managed Program. For more details, visit:

China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty