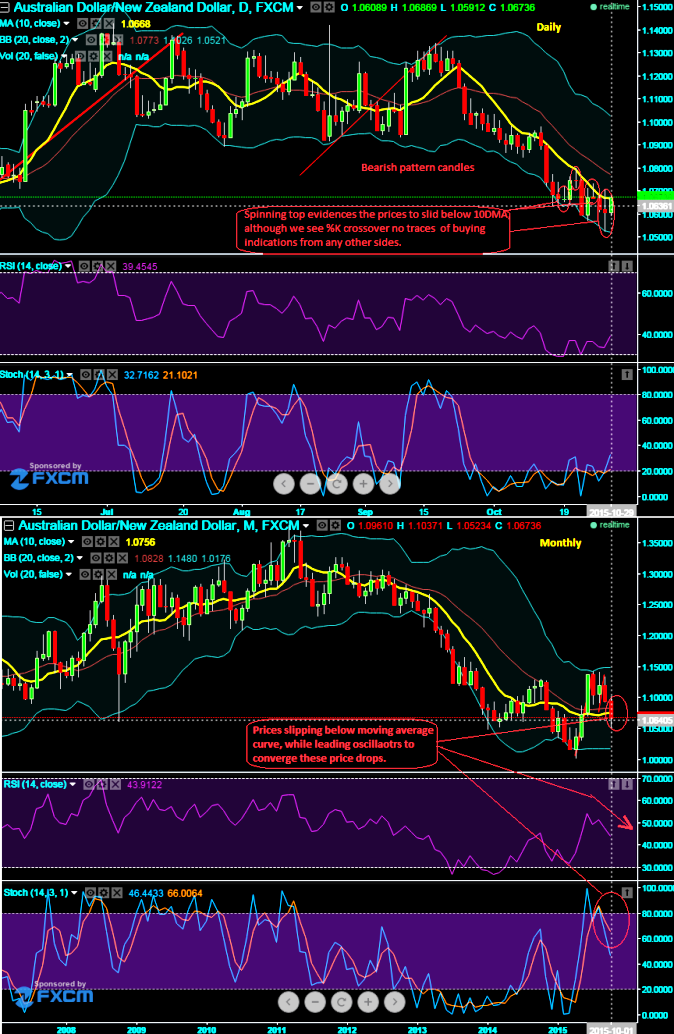

We kept reiterating this APAC pair's bearish trend often and often, now observe the daily price slumps on above charts.

We spotted out a bearish spinning top at 1.0608 with day's lows at 1.0523 thereby our earlier target is very well achieved at 1.0747 and 1.0555 levels.

Prior to this spinning top we also observed series of doji patterns in the recent past at 1.0666, 1.0746 and again at 1.0670 levels.

On monthly charts also, the prevailing prices of this APAC pair falls well below 10DMA that signifies the long term downtrend to prolong, while leading oscillators shows downward convergence to the price dips.

Although an attempt of %K crossover seen near oversold regions there was no substantiation from any other indicators. Hence, we could not afford to jump the guns by interpreting this as buying call on an isolated indication solely on stochastic curve.

Fundamentally, RBNZ leaves OCR unchanged at 2.75%, as eyed, statement dovish, further easing likely, especially so if NZD keep moving up, concerns over China still lingering, Reuters poll - market eyed Dec OCR cut.

On the flip side, Australian new home sales in September dropped to -4.0% m/m - HIA.

Australia Q3 export prices unchanged, -5.2%.

Before initiating any trades, please refer further readings to check out our earlier magics:

http://www.econotimes.com/FxWirePro-Never-buck-the-trend-as-momentum-and-lagging-indicators-signal-AUD-NZD-to-extend-loses-102506

http://www.econotimes.com/FxWirePro-More-potential-yields-on-AUD-NZD-option-strips-104933

FxWirePro: Spinning top evidencing below 10DMA signals AUD/NZD bearish trend to sustain – likely to retest target at 1.0555

Thursday, October 29, 2015 8:06 AM UTC

Editor's Picks

- Market Data

Most Popular

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings