Asian equity strategists seem to be quite constructive on equities and reckon that the fundamental risks have diminished post the political events this quarter (Chinese National Congress, Japanese elections etc).

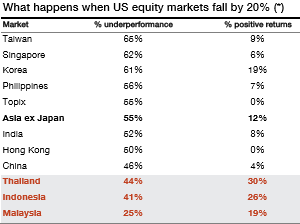

Nevertheless, they are concerned about valuations in the US and the “bull market in everything”, and trust that the encouraging standpoint on Asian equities could be derailed by draw-downs in the US. In an effort to ascertain the sensitivity of Asian equities to severe historical draw-downs in US equities, SG team have looked at previous such episodes of larger than 20% draw-downs. They present results across country indices and sectors, but to summarise, Taiwan stands out to show the most frequent underperformance, closely followed by Singapore and Korea.

The above chart demonstrates the 6-month ATM implied volatility of various Asian indices against the statistic from our Asia equity strategy team’s analysis (% of the time an index has underperformed the S&P 500 in 20% or larger draw-downs). We find that Korea and Taiwan screen as the cheapest volatilities to own.

Buy TWSE downside options to hedge against a wider equity sell-off Buy TWSE Jun18 10000 strike put for 164 TWD (1.54% premium, ref 10651.11, -28 delta, 13.7% vol).

The sensitivity of Taiwanese equities to any negative re-pricing in global growth, a downturn in the global tech cycle and any escalation in North Korean risks make them ideal as a risk-off hedge for equities. The low volatility makes the case even more compelling. We recommend buying a 6-month OTM put on the Taiwan Stock Exchange Weighted Index (TWSE) to position for any downside in equities.

Risks: the total loss on the option strategy is limited to the premium paid up-front.

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts