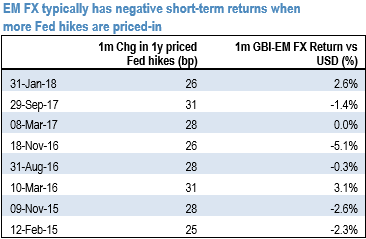

The short-term repricing of Fed hikes is typically not supportive of EM FX returns, which also motivates our selective hedges (e.g. TRY and MXN). The recent research in the past emphasized the distinction between increases in core yields driven by rising breakeven inflation (good bond sell-off) versus rising real yields (bad bond sell-off).

The above nutshell illustrates the episodes since 2013 that saw another Fed hike being priced in by the market over a 1m period. Typically, EM FX had negative returns over those periods, although there were some which did not conform to this, such as in March 2016 when EM was going through a cyclical recovery from the lows, and in January 2018.

Three Fed hikes are currently priced in for the next 12 months, and our economists see a likely revision to the Fed dot plot at the March FOMC meeting to indicate four hikes this year. This could add some short-term pressure to EM FX in the run-up to the meeting.

Trading tips:

We are neutral EM FX amid a more balanced short-term risk outlook

EMEA FX: We are MW in EMEA EMFX emphasizing RV plays. In CEE, we now have the highest conviction on our tactical short EURHUF trade added last week. Our conviction on short USDPLN has dropped, but we still believe the direction will be lower for the currency.

EM Asia FX: Neutral in the GBI-EM Model Portfolio but outright longs in SGD, KRW, and TWD, as EM Asia FX strength can play a part in mitigating trade tensions over the medium term.

Latin America FX: Maintain long JPYMXN and long USDCLP. Keep OW BRL and ARS, and UW MXN on medium-term considerations and UW PEN as a hedge.

In a standard carry trade, one takes advantage of a positive interest rate differential between two currencies. This position tends to perform in an environment of depressed volatility since the limited FX risk preserves the yield. However, the long high-yielding currency is almost always pretty volatile when it falls (think of emerging currencies), so the incremental carry profit can be destroyed in a wink if market sentiment deteriorates.

Sell 1Yx1Y USDTRY FVA vs buy 1Y ATM call.

Buy USDTRY call (4.00) and EURTRY call (4.83) (equal weighted USD notional).

FxWirePro launches Absolute Return Managed Program. For more details, visit:

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook

BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell

Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty