The joy of the USD bulls following the sturdier than anticipated US inflation data yesterday seems to be momentary. Immediately following the publication USD did appreciate only to then nose-dive.

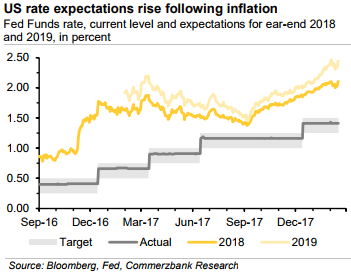

Despite the fact that the inflation data was clearly positive: both the overall rate (+0.5% mom) as well as the core rate (+0.3% mom) clearly surprised to the upside thus confirming the fears or hopes kindled by the labour market report that the Fed might hike interest rates more quickly than expected - the Fed rate expectations rose yesterday (refer above chart).

That means everything is pointing towards rising real interest rates in the US, a fact that should benefit USD. But it doesn’t. Why?

We stay long EM FX in our region but acknowledge several indicators now look stretched. The EM asset class has enjoyed record inflows so far this year.

Cumulative inflows into EM equities and local fixed income stand at +$24.5bn and +$5.0bn, respectively.

EM FX positioning in the JPM Local Markets Client Survey from 25-Jan has risen to the highest OW level since July-2007.

The EM FX risk appetite index, which agglomerates available high-frequency indicators about flow, positioning and market pricing is now 3.28 standard deviations positive, highest in the series history (refer 1st chart).

Finally, EM FX has now performed well despite higher core yields and lower equity prices. Importantly, breakeven inflation contributed to the higher US 10y yields but about half of the move has been driven by real yields (refer 2nd chart).

Historically, higher contribution from real yields tends to be more negative for EM.

FxWirePro launches Absolute Return Managed Program. For more details, visit:

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures