This week, the major central banks (Fed, BoJ and BoE) are centre of attraction as they are scheduled for respective monetary policies, on Wednesday, the Federal Open Market Committee will meet for the final time in 2018, and there is a higher-than-usual degree of uncertainty. So, what do we expect to occur at the upcoming meeting? BoJ is lined up on Thursday, to maintain negative rates on hold.

USDJPY fell from 113.50 to 112.70, the defensive yen has been the top performer of the day. We feel quite fortunate to be exiting in the black having owned USDJPY through a deep and sometimes volatile correction in US stocks. This wasn’t entirely happenstance - we have argued that structural capital outflows from Japan together with super-wide front-end differentials would dull the yen’s immediate sensitivity to certain falls in risk markets.

But we don’t want to stick around too long to find out where the pain threshold for Japanese investors might actually be - we assume that even corporates will slow their accumulation of foreign assets in response to a sufficiently adverse set of macro or market conditions.

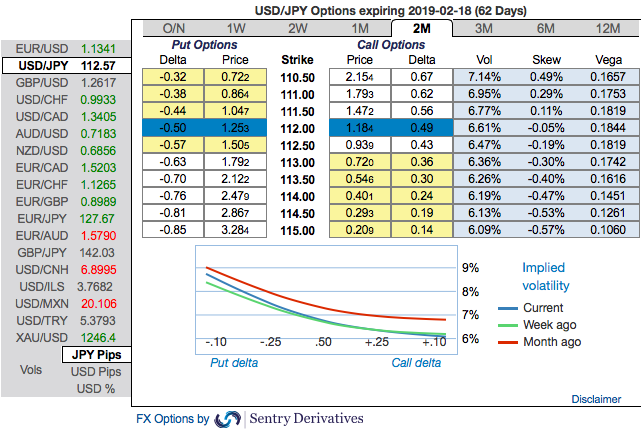

USDJPY OTC update and options strategy as follows: Most importantly, please be noted that the positively skewed IVs of 2m tenors are signifying the hedging interests for the bearish risks. The bids for OTM puts of these tenors signal that the underlying spot FX likely to break below 110.50 levels so that OTM instruments would expire in-the-money.

While negative risk reversal numbers of USDJPY across all tenors are also substantiating downside risks amid any momentary upswings in the short-run. IVs for 2w tenors are on lower side which is good for put option writers, while 2m IVs are on higher side which is good for put holders.

OTC positions of noteworthy size in the forex options market can stimulate on the underlying forex spot rate. The spot may trend around OTM put strikes as the holders of the options will aggressively hedge the underlying delta.

Accordingly, couple of days ago the debit put spreads have been advocated, we would like to uphold the same strategy but with diagonal tenors on hedging grounds.

While both the speculators and hedgers for bearish risks are advised to capitalize on the prevailing price rallies and bidding theta shorts in short run and 3m risks reversals to optimally utilize delta longs.

At spot reference of USDJPY: 112.573 levels, we advocate buying a 2M/2w 113.723/110.00 put spread ahead of Fed and BoJ monetary policies (vols 6.68 vs 5.68 choice), wherein short leg is likely to function if the underlying spot FX keeps spiking, we would like to maintain the ITM long leg with the diagonal tenors on hedging grounds.

Currency Strength Index: FxWirePro's hourly JPY spot index is flashing at 46 levels (which is bullish), while hourly USD spot index was at 93 (bullish) while articulating at (07:37 GMT).

For more details on the index, please refer below weblink: http://www.fxwirepro.com/currencyindex

China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks

MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated

Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close