Futures contracts in Comex for the yellow metal has shed around $3.00, or about 0.3%, to $1,255.29 a troy ounce by 07:00GMT.

Front-end and intermediate US Treasury yields declined 1-4bp, as CPI disappointed relative to expectations, suggesting a slowing in underlying inflation.

While the weakness in CPI gives us pause, we think the FOMC is on track to raise rates again in June: the unemployment rate sits at its lowest level in more than a decade and below the Fed’s near-term and longer-run projections.

Hold 3-year duration shorts. The collapse in FRA/OIS spreads looks somewhat overdone, but the recovery could be slow and fitful. Fair value and dealer positioning support higher vols; buy the 3Mx5Y straddle.

The precious metal is sensitive to moves in U.S. rates, which lift the opportunity cost of holding non-yielding assets such as bullion. A gradual path to higher rates is seen as less of a threat to gold prices than a swift series of increases.

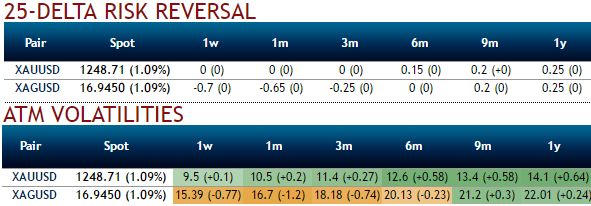

Elsewhere, OTC bullion market indicates uncertainties about bullion prices, the above sensitivity tool evidencing delta risk reversals and IV skews evidence gold prices’ momentary edginess and upside risks in long run. Positively skewed IVs of 2m tenors indicates hedgers’ interests in both OTM put and call strikes, while neutral delta risk reversal number indicates topsy-turvy swings in this precious commodity prices.

Thus, envisioning the short term range bounded trend and uncertain trend in long term from above OTC market’s rationale; we reckon that the calendar straddle would be more advantageous to keep priced fluctuations on the check.

The strategy could be executed by shorting a near-term straddle while buying a longer term straddle with an intention to profit from the rapid time decay of the near-term options sold.

Well, it is a limited return with the limited risk strategy entered by the options trader who ponders over that the underlying spot commodity price would experience very little volatility in the near term (please refer above nutshell).

Execution: Stay short in ATM call and ATM put of 1m expiry, while simultaneously buy 6m +0.51 delta call and -0.49 delta put of the similar tenor at net debit.

Maximum loss for the calendar straddle is limited and is likely incurred when the spot price had moved hugely in either direction on the expiration of the near-term straddle.

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges