In contrast to most other currencies, Sterling has hardly benefited from the improved market sentiment in recent weeks. The British currency was only able to gain little ground against the safe haven currencies, the Japanese yen, Swiss franc and the US dollar. But even that can be attributed more to a pronounced weakness of these currencies rather than to a stronger pound.

Several factors have recently taken their toll on the British currency:

- The UK has become the corona hotspot within Europe, which raised doubts about the government's ability to effectively contain the virus.

- The Bank of England has signalled further stimulus measures in view of the corona-induced economic slump.

- The risk of a no-deal Brexit at the end of this year has yet again increased significantly after the negotiations between the EU and the UK on a trade agreement appear to have reached an impasse.

These trios reinforces the potential weakness of the sterling in the days to come. Given that the UK and EU should have a strong interest in the conclusion of a free trade agreement, given the already difficult economic situation caused by the corona crisis, our economists are confident that an agreement on an extension of the talks in the second half of the year remains possible. Nevertheless, they also believe that the probability of a no-deal Brexit has increased significantly. For this reason we are forecasting a weaker pound in the short term and only a very moderate recovery later in the year. In fact, there is a high risk that the pound will suffer much more severe setbacks in the meantime than our forecasts suggest due to rising Brexit risks, hence, we are already short in GBPUSD via optionality.

The rationale: GBP will likely take its directional cue from the read-through to BoE’s rate cut whereas the size of the move will be augmented or moderated by the government’s broader policy platform, and most importantly, all these underlying news are factored-in GBP’s FX options market.

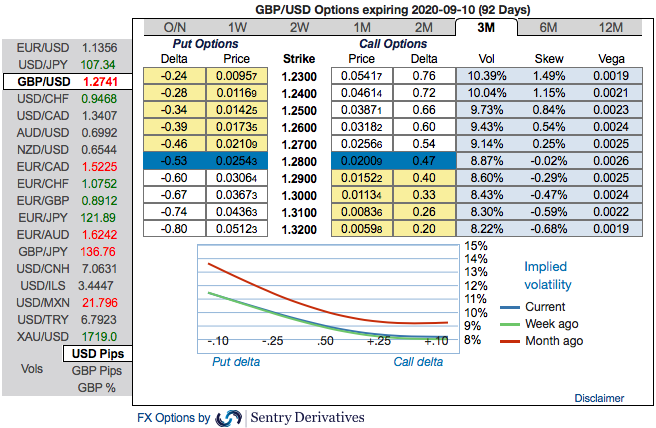

You could observe 3m GBP skews that has stretched towards negative territory, hedgers have shown interests for bearish risks as you could see more bids for OTM Put strikes up to 1.23.

To substantiate the downside risk sentiment, fresh negative bids of risk reversal numbers have still been signalling bearish hedging sentiments in the long run. Accordingly, we advocate the diagonal options strategy on both hedging and trading grounds.

Though the underlying spot FX is showing some resistance to the prevailing bearish streaks, these rallies seem to be momentary. Hence, this is right time to write deep OTM put options.

Execution of strategy (Debit Put Spread): Capitalizing on the above factors, it is prudent to deploy diagonal options strategy by adding short sterling via a limited loss tail hedge: Stay short a 2M/2W GBPUSD put spread (1.22/1.2850).

Alternatively, activate shorts in GBPUSD futures contracts of July’20 deliveries with an objective of arresting potential slumps. Courtesy: Sentry, Saxo & Commerzbank

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields