No doubt, GBPUSD has been performing considerably well in the consolidation phase of its major trend. However, the question is that road ahead for sterling in 2018 remains clear. Almost three quarters after the UK began the Brexit proceedings, the terms of the divorce majorly seem to be steady. The UK and the EU would now move on to negotiations for a transition period and future UK-EU trade. These must be finalized by October 2018 to give the EU27 six months to indorse any deal.

The EU27 looks set to give the green signal to enable Brexit negotiations to move from ‘divorce’ issues to the next stage on a transitional period and a new relationship. German Chancellor Merkel said that UK PM May “has made good offers, which might make it possible for the EU27 to see sufficient progress”.

While in the UK, the Times reported that the government is expected to back down from writing into legislation the Brexit date of 29th March 2019, which is perhaps another sign that the probability of an orderly departure has risen.

EU leaders likely to agree for the Brexit talks into their second phase, eyeing on the UK to provide more clarity on the sort of deal it wishes for. While arriving for the second day of an EU summit in Brussels, Jean Claude Juncker, the president of the EC, hinted that negotiations on the future relationship would begin “as soon as possible.”

While the BoE has reversed the pre-emptive interest rate cut after the Brexit referendum in 2017. However, as this does not mark the start of a hiking cycle, monetary policy will no longer give any momentum. Even if it Britain and the EU will start phase II of the Brexit negotiations in the coming months, the process remains extremely slow and tedious, not least because of the tensions within the British Government. The pound thus remains the pawn of progress or setbacks in the Brexit negotiations and thus volatile. The downside risks also prevail in 2018.

OTC outlook and options strategy:

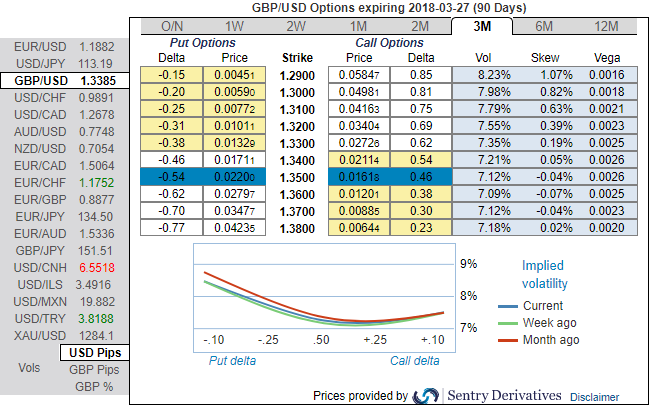

Let’s glance at sensitivity tool and risk reversals that indicate no changes in the hedging sentiments for bearish risks of the underlying spot FX prices.

Positively skewed IVs of 1m/3m tenors have been signifying the hedgers’ interests of both OTM call/put strikes respectively that means the ATM instruments have the likelihood of expiring in-the-money within their respective tenors.

Hence, in order to arrest this upside risk that is lingering in intermediate trend and major declining trend, we recommend options strap strategy that favors underlying spot’s upside bias and mitigates any abrupt bearish risks.

So, we recommend building the FX portfolio exposed to this pair with longs positions in 2 lots of 1M ATM 0.51 delta calls and 1 lot of ATM -0.49 delta puts of 3m expiries, these options positions construct smart hedging at net debit.

Currency Strength Index: FxWirePro's hourly GBP spot index is inching towards 5 levels (which is neutral). While hourly USD spot index was at shy above -75 (bearish) while articulating (at 07:18 GMT). For more details on the index, please refer below weblink:

http://www.fxwirepro.com/currencyindex

FxWirePro launches Absolute Return Managed Program. For more details, visit:

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings