The sterling has outperformed other major currencies since the US election, with no obvious driver except perhaps the suggestion that the new US administration may favor the US and UK trade deal. GBPUSD backed up to as high as 1.2585.

However, in long run, we still foresee the risk of another downside test, but that move should complete the bear cycle we have been in from the 2007 highs at 2.1160.

A major base is then expected to develop for an ultra-long term move back towards the 1.55- 1.70 region.

We have been highlighting in recent publications that the ongoing High Court proceedings posed a near-term risk to core bearish view on GBP and that the currency had the potential to rise a few pct if the High Court ruled against the government.

Indeed this is why we had recommended holding GBP shorts in options rather than cash.

This risk was realized this week as the High Court ruled that Parliamentary assent was required before the government can set in motion the Article 50 process.

As expected, the government has appealed the decision in the Supreme Court, which will be heard between December 5th and 8th, but the majority of legal commentators believe that the Supreme Court will uphold this judgment.

For good measure, GBP received a secondary boost from a BoE which dropped its easing bias due to less favourable policy trade-off (more growth, a weaker pound, and more inflation).

While the relief for GBP on the UK High Court decision is understandable, we nevertheless expect it to be temporary. The bottom line is that the Parliament would to vote to invoke Article 50 even if the Supreme Court concurs with the decision this week.

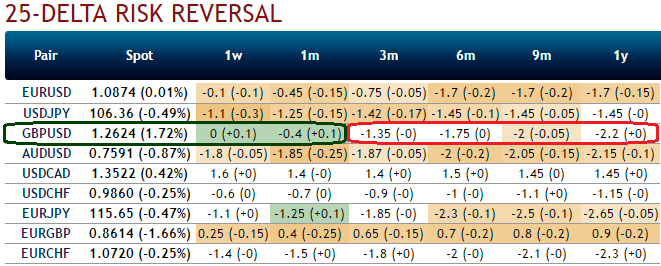

Buy 3m risk reversals, while shorting 1m RRs as 3m ATM IVs are considerably higher above 10%. Keeping risk reversal, IV and above fundamental factors in mind that could be adding strength to GBP in short run, it is advisable to go long in 2m ATM -0.49 delta put while writing 1m (1.5%) ITM put with positive theta and delta closer to zero at net credits (both sides use European style options).

Alternatively, the risk averse can buy 1m2m GBPUSD 1.2860 - 1.2350 put spread, sell a 2m 1.2860 OTM call.

Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges