Sterling has been the underperformer among G10 FX space, thanks to the chaotic Brexit process to date. The Q1 outlook for the cross is binary: either a friendly Brexit or not.

While the UK government has cancelled a parliamentary vote on the divorce settlement. UK Prime Minister May is to go to Brussels to renegotiate. One of the many EU presidents (Tusk this time) has said the EU will not renegotiate but it will help get ratification which sounds a bit like a soft renegotiation.

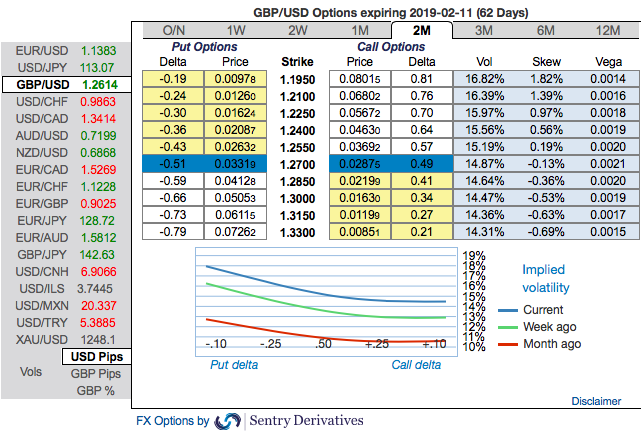

OTC hedging updates: Please be noted that the positively skewed IVs of GBPJPY of 2m tenors signify the hedgers’ interests to bid OTM put strikes upto 134 levels (refer above nutshells evidencing IV skews).

As both interpretations make sense they are balancing the spot market and GBP spot levels are reacting hardy at all. Only volatility is increasing.

It remains more expensive to hedge against strong GBP depreciation, which means that an orderly Brexit in whatever shape is still seen as being more likely. However, the risk of things going wrong is high and as a result, we regard any GBP appreciation with much scepticism.

Although you are seeing risk reversals showing fresh positive bids to the existing bearish setup, while the positively skewed GBPUSD implied volatilities of 2m tenors still signal bearish hedging sentiments. To substantiate this downside risk sentiment, risk reversals have also been in negative territory adding minor negative bids in the short-run. We see less volatile swings in GBPUSD, if you plot weekly technical chart.

Currency Strength Index: FxWirePro's hourly GBP spot index is showing -24 (which is mildly bearish), while USD is flashing at -4 (which is neutral), while articulating at (09:40 GMT).

For more details on the index, please refer below weblink: http://www.fxwirepro.com/currencyindex

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed