A brief rally, on the back of the UK Government winning the vote yesterday, held under the highlighted resistance in the 1.3230-1.3290 region. The sterling has failed to make any real headway after the UK Government won a key vote on the Brexit bill in the House of Commons yesterday.

While Focus today turns to the Bank of England policy announcement. Having got cold feet at last month’s meeting following weak Q1 GDP data, the MPC is likely to wait until August, the BoE was knocked off their hawkish stance recently as a slump in economic figures for the UK's economy that was expected in the first quarter threatens to slip into the second half of the year.

Momentum remains down, but we do see support in the 1.3110 regions, ahead of significant medium-term support in the 1.30-1.2935 region. We are still awaiting evidence of a medium-term base developing at these lower levels, so are watching how prices trade around the main support regions.

We reckon the bear cycle that started back in 2007 at 2.1160 completed at 1.1490. On a multi-year basis, this suggests mean reversion back to 1.50-1.60 in a long run again, but not in any near future.

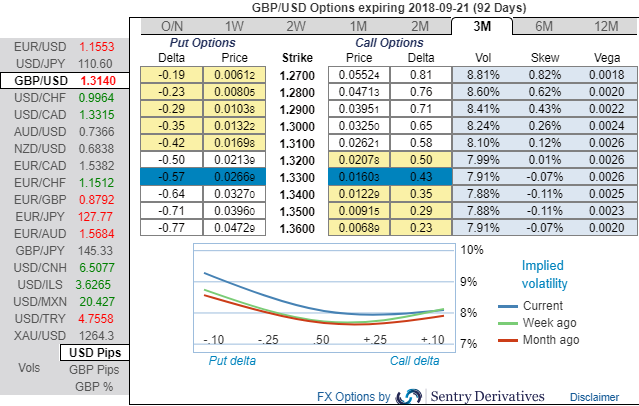

One can observe the increase in negative risk reversal numbers of GBP pairs in short run that signify the hedging sentiments for the bearish risks and vice versa in the long run which is well in line with our above-stated projections.

Let’s glance at GBPUSD sensitivity tool, the positively skewed IVs of 3m tenors are signaling the hedging interests in the bearish risks, 3m bids are upto 1.27 levels. As a result, OTM puts strikes likely to expiring in-the-money.

Accordingly, FX options transactions are entered into as a hedge against an unfavorable probable future event. Foreign exchange options (also known as FX, forex or currency options) are contracts where the buyer has the right, but not the obligation, to exchange currency on a certain future date at the exchange rate and in the amount fixed at the time of entering into the transaction.

Currency Strength Index: FxWirePro's hourly GBP spot index is flashing -114 (which is bearish ahead of BoE monetary policy today) while articulating (at 09:49 GMT). For more details on the index, please refer below weblink:

http://www.fxwirepro.com/currencyindex

FxWirePro launches Absolute Return Managed Program. For more details, visit:

US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty

Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data