Brexit negotiations resumed last week and scheduled in Brussels today. The focus now turns on the meeting between EU’s Chief Negotiator Barnier and the UK’s Brexit Secretary Raab as the need for the progress is becoming exceedingly vital, with some key autumn deadlines fast approaching. The UK would likely publicise the first of a series of technical notices on Thursday to prepare for the possibility of ‘no deal’, according to the sources of Lloyds.

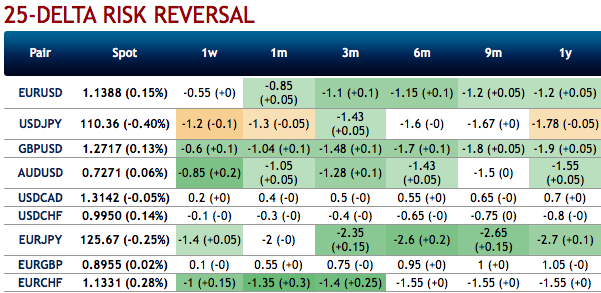

While the risk of a “No Deal Brexit” appears to be slightly waned again from the market’s standpoint, at least that is what the option markets are suggesting at this juncture as minor positive shifts in risks reversal (RRs) numbers are observed for the mild bullish risks, where the prices for hedges against a collapse of Sterling have eased again (refer above nutshell evidencing RRs, you could figure out slight shift in hedging sentiment across all tenors).

It seems quite unforeseen that there was no driving force to support this development – quite the contrary. It became known yesterday that the British government has already prepared a plan to confront a no-deal scenario that would be published bit by bit so that companies and private households can prepare accordingly.

The chief negotiators of both sides will meet again today to continue the negotiations. Unless this results in some clear progress it would be sceptical about the recent GBP calm.

Currency Strength Index: FxWirePro's hourly GBP spot index is flashing at 43 levels (which is bullish), while hourly USD spot index was at shy above -85 (bearish) while articulating (at 13:38 GMT). For more details on the index, please refer below weblink:

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields