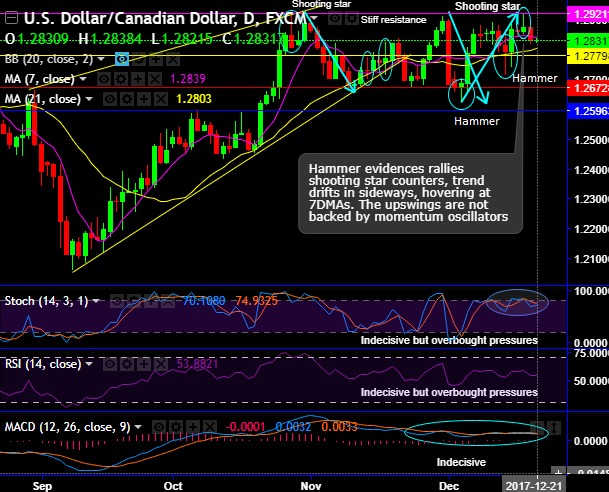

Candlestick pattern formed – Shooting star and hammer pattern candles on dailies and hammer on monthly plotting.

Please be noted that both bullish and bearish patterns have occurred and they have shown their effects so far. Shooting stars have formed at 1.2807, 1.2875 levels and hammer pattern at 1.2686 and 1.2794 levels.

Meanwhile stiff resistance is observed at 1.2921 levels where we’ve seen strong supply zone. On the flip side, the major supports are observed at 1.2672, 1.2696 and 1.2699 levels.

While both the hammer and shooting star patterns are evidencing bullish and bearish effects, the trend seems to be perplexed, in such a puzzling circumstance, both leading as well as lagging oscillators (RSI, Stochastic and MACD), have absolutely been indecisive. As you could see all these indicators are drifting non-directional mode.

On a broader perspective, hammer pattern candlestick has appeared exactly at 50% Fibonacci retracements, ever since then the sharp spikes are observed. But for now, 3-months’ consolidation phase now seems exhausted exactly at 21EMA levels (refer monthly chart).

Trade tips:

Contemplating above perplexed circumstance, while technical indicators are vulnerable to indicate the clarity in trend, it is wise to buy boundary binary options strategies with upper strikes at 1.2880 and lower strikes at 1.2780, the above strategy is deployed for a limited yields but certain yields as long as spot FX remains between above strikes on or before expiration.

Currency Strength Index: FxWirePro's hourly USD spot index is inching towards -53 levels (which is bearish), while hourly CAD spot index was at 33 (bullish) while articulating (at 10:35 GMT). For more details on the index, please refer below weblink:

http://www.fxwirepro.com/currencyindex.

FxWirePro launches Absolute Return Managed Program. For more details, visit: