Earlier in January, we closed our long gold trades in order to lock in profits ahead of the largely uncertain risks around Trump’s inauguration and the kick-off of his presidency. Obviously, both those immediate catalysts have passed but arguably, much of the uncertainty remains. Yet, from our perspective now, we view this lingering ambiguity as a potential extra accelerant to a near-term, fundamental-based rally in gold.

On treasuries, Fixed Income research analysts reiterate that “although there is room for high yields in short run, gold's safe haven sentiments to remain intact in long run” given their skepticism on large-scale fiscal stimulus and the potential for growth to moderate among other drivers like seasonality and stretched investor positioning to the short side in gold.

From an FX perspective, while long dollar positioning remains material even after the retracement lower in the dollar index YTD, our analysts believe, “the broad dollar does still seem vulnerable should Trump’s first several days in action disappoint those looking for primarily growth-friendly and reflationary policies, without stoking disruption or trade-confrontation risks.”

Combining these macro views with the general sense of uncertainty in markets (safe haven demand) and the relatively clean investor positioning in gold, compels us to recommend going long in gold.

OTC outlook and hedging strategy:

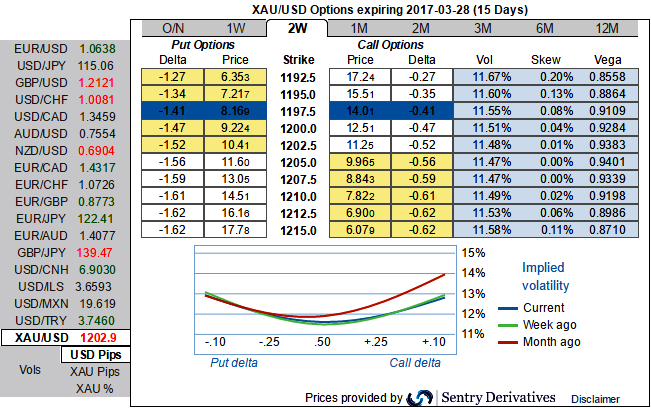

Neutral delta risk reversals of XAUUSD: From the nutshell showing delta risk reversals of gold prices, you can probably make out that this commodity has been the most expensive pairs to be hedged for short term downside risks as it indicates calls have been relatively overpriced over puts, short term IVs seem more conducive for option writers.

Needless to specify, Gold price vols have still been fading away, no pace owing to the monetary policies of the US Federal Reserve, investors seem to be shifting safe haven investment sentiments into the treasuries as the more hawkish notes are intensifying the interest rate hiking cycle.

Positively skewed 2w IVs are indicating opportunities for writers of the exorbitant call options, while 2m skews are in favor of calls to mitigate bullish risks.

Hence, we advocate the longs in 2M ATM 0.51 delta calls while long in ATM -0.49 delta put option of 2m tenors, simultaneously, short 1m (1%) OTM calls, the hedging portfolio is constructed at net debit with 56% of net delta. But the cost of hedging portfolio has been reduced from short leg.

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics