Owning USD calls/CHF puts or USDCHF risk reversals as long USD plays:

Unwind long EURCHF outright and rotate into long USDCHF via a risk reversal, which in conjunction with a pre-existing spot long in USDJPY, positions the portfolio for an ongoing improvement in the US economy.

Rotate long EURCHF into long USDCHF via risk reversal; keep EURUSD call spread, the much-awaited ECB meeting was modestly dovish and with it, Draghi was able to deliver euro weakening alongside a QE “taper” announcement for the second time in a year.

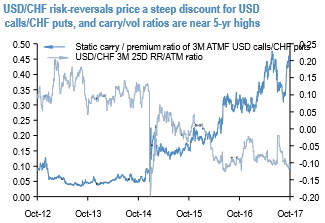

It is stated that USDCHF is one of the only two USD pairs (the other being USDJPY) where owning USD calls has been profitable on a delta-hedged basis since they earn smile theta along a risk-reversal that is bid for USD puts to reflect a premium for a 2015 franc de-peg-like SNB tail event.

In addition, long USDCHF directionally is a positive carry proposition, hence risk-reversals without delta-hedges lean long USD while earning both time decay and forward points.

The RV edge is that risk reversals are depressed via-a-vis ATM vols, which are themselves historically cheap relative to carry in forwards (refer above chart).

A 15’Dec17 (post-December FOMC) 1.01 / 0.98 risk-reversal costs 15bp premium (spot ref. 1.0008), has a very decent spot-to-strike distance ratio of the call and put legs of 1:2.5 and suffers negligible bleed till the final two weeks of its life.

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays