In this write-up, we emphasize on a strategy of FVA 1*2 spreads. Utilizing luring pricing and positive rolldown, 1x2 FVA spreads are time passage friendly and low maintenance long vega positions that struck us as a solid buy in the current environment where low decay vega is well sought after. The basic construct involves selling shorter-dated FVA along with an upward-sloping segment of the vol curve to partially fund the purchase of a longer-dated FVA that sits on a flatter part of the term structure. The roll-down of the short leg then compensates (or even eliminates, as is the case for CADJPY) the slide of the long position, all the while preserving the overall structure’s net long vol characteristic. The short leg is not large enough to disrupt the net positive sensitivity of the package to vol upturns.

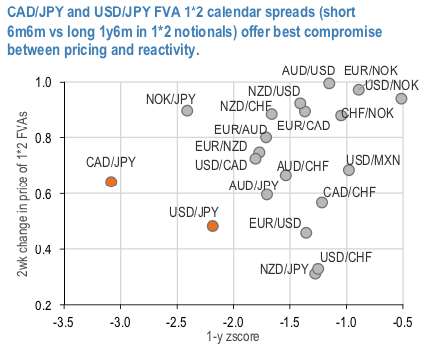

Consequently, the structure is a carry efficient risk-off hedge. We screen for the FVA spread candidates based on their pricing (in form of a 1-y z-score) and the sensitivity to the ongoing market turbulence (in form of 2-week change in pricing of the package) – (refer 1st chart).

In the case of CADJPY, the current levels are still a bargain by historical standards, even after the recent bounce. The net 6-month static vol slide (at the expiry of the short leg) deteriorated as the front vols spiked on the back of the recent spot gyrations but is still positive thus making the long/short structure superior to holding a similar long-dated straddle (refer 2nd chart).

Consider short 6M6M CAD/JPY @8.7ch vs long 1Y6M @8.55/9.05, in 1:2 vega weights or short 6M6M USD/JPY @7.6ch vs 1Y6M @7.55/7.95 indic, in 1:2 vega weights. Courtesy: JPM

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics