With the volatile markets, global trade turbulence, elections and geopolitics, “risk” was one of the key business words of 2018. It is completely normal that the yen eased intraday yesterday and also today. Of course, the flash crash of the exchange rates on Wednesday night would not have been possible without any fundamental justification: “risk-off” in times of increasing economic concerns.

However, episodes like the one we saw yesterday also have the tendency of overshooting. The largest share of overshooting (e.g. USDJPY below 105) was corrected right away, but after that the FX market has to shake itself down a little. What is the residual effect that is acceptable for the average FX market participant?

In the case of marginal exchange rate moves this process happens continuously, in the case of major distortions like the one seen two night ago this takes some time.

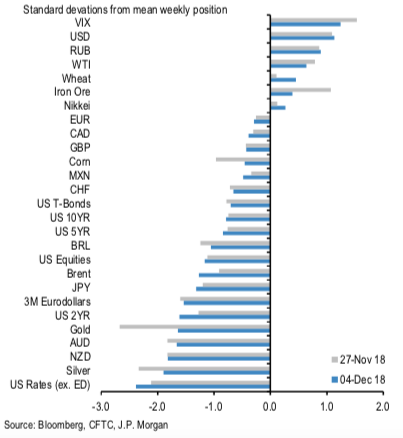

Difference between net spec positions on risky & safe currencies.

Net spec position is calculated in USD across 5 "risky" and 3 "safe" currencies (safe-haven currencies also include Gold).

These positions are then scaled by open interest and we take an average of "risky" and "safe" assets to create two series.

The chart is then simply the difference between the "risky" and "safe" series.

The final series shown in the chart below is demeaned using data since 2006.

The risky currencies are: AUD, NZD, CAD, RUB, MXN and BRL.

The safe currencies are: JPY, CHF and Gold. Courtesy: JPM

Currency Strength Index: FxWirePro's hourly EUR spot index is inching towards -31 levels (which is mildly bearish), while hourly USD spot index was at 37 (mildly bullish), while articulating (at 12:16 GMT).

For more details on the index, please refer below weblink: http://www.fxwirepro.com/currencyindex

2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms