Year-2018 for cryptocurrency has had the mixed bag of sentiments amid series of regulatory and fundamental news.

Cryptocurrency derivatives have been the centre of attraction in the recent past. Cryptocurrency derivatives, including cryptocurrency futures, cryptocurrency CFDs, and cryptocurrency options) have been under the meticulous scanner of the renowned global regulators, such as, US SEC, CFTC and UK’s Financial Conduct Authority (FCA).

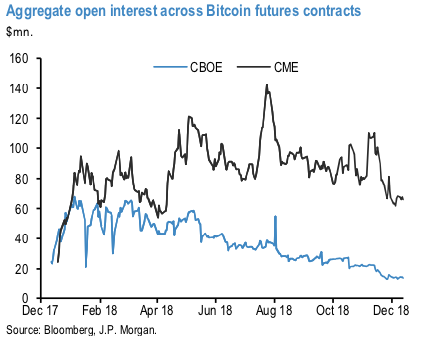

Participation by financial institutions, proxied by Bitcoin futures volumes in CBOE and CME, has declined also.

As 1stchartshows, open interest in the CME contract, where futures activity has increasingly concentrated, has declined to $65mn this week, at the very low end of this year’s range (refer 1stchart).

The open interest in the CBOE contract continued its downtrend to the lowest level since inception.

More importantly futures volumes as a proportion of trading volumes on bitcoin exchanges has declined to below 1%, the lowest level since the beginning of the year and well below the 10% high seen in the summer (refer 2ndchart).

In other words, participation by financial institutions in bitcoin trading appears to be fading. Courtesy: JPM

Trade tips: At spot reference: 3704 levels, on trading grounds, one can initiate BTCUSD boundary option spread strategy with upper strikes at 3900 and lower strikes at 3515 levels.

The trading between these strikes likely to derive certain yields in this perplexed trend in the short term, more importantly, these yields are exponential from spot movements.

For cash or nothing, these options would be exercised if the forward prices to remain between both strikes (i.e. 3900 > Fwd price > 3515 levels).

Alternatively, one could initiate long positions in CME BTC futures contracts of near month tenors with a view of arresting upside risks.

Currency Strength Index: FxWirePro's hourly BTC spot index is inching towards -31 levels (which is mildly bearish), while hourly USD spot index was at 37 (mildly bullish) while articulating (at 12:01 GMT).

For more details on the index, please refer below weblink: http://www.fxwirepro.com/currencyindex

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes