AUDNZD in a neutral state near term, a 1.0600-1.0700 range likely to contain.

In medium term perspective, we could foresee the potential for a further decline towards 1.0493 during this month, given recent interest rate and commodity movements have slightly favored the NZD. Further out, it could target 1.10 also on the flip side which is close to fair value.

On both trading and hedging grounds, AUDNZD major downtrend has been drifting in consolidation phase but now jerky in the medium run, this may cause price slumps upto 1.08 levels (recent lows).

We expect the 1.0690 areas which can’t be disregarded if iron ore remains under downward pressure. A retest of the 1.09 area is also possible if iron ore’s rally since mid-June continues and global risk sentiment remains elevated.

We’ve seen the bearish impact on underlying AUDNZD movement in the major trend. Technically, the price behavior has been weaker with both leading as well as lagging indicators are bearish bias.

Options trading strategy:

Volatility is the heart and soul of options trading. With the proper understanding of volatility and how it affects your options, you can profit in any market condition. The markets and individual asset class are always adjusting from periods of low volatility to high volatility, so we need to understand how to time our options strategies.

When we talk about volatility we are referring to implied volatility. Implied volatility is forward-looking and shows the “implied” movement in an underlying asset’s future volatility.

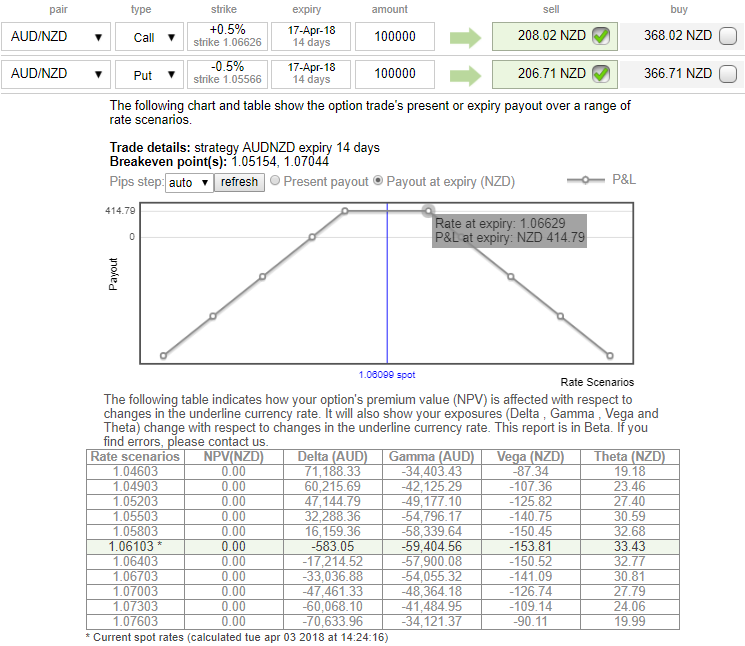

Hence, to keep these volatilities on the check, we advocate options strategies as shown in the above diagram:

Strategy overview: Investor reckons that the AUDNZD price action would be continued in the same range bounded trend amid lower IVs.

The execution: On trading grounds, short 2w (0.5%) out-of-the-money call and (0.5%) out-of-the-money put of the similar expiry.

Profit potential: Limited.

Risk profiling: Unlimited as the underlying spot FX goes beyond above-stated strikes on expiration.

Margin: Margin needed.

On trading grounds, one can deploy strangle shorting by selling OTM instruments for the net credit.

This strategy is suitable when trader reckons that the market won’t be volatile and broadest range bounded. Please be noted that the margin is required on short options, where returns would be limited exposing to unlimited risks.

Hedging strategy:

Contemplating above fundamental developments and the ongoing technical trend of this pair, to participate in the puzzling swings, we advocate option strips strategy that contains 3 legs of vega longs (2 puts plus 1 call). The option strips that likely to fetch desired yields regardless of the trend but more potential on southwards by arresting bearish risks.

As shown in the diagram, the execution goes this way: Initiate 2 lots of 1m longs in Vega put options, simultaneously, add 1 lot of Vega call options of the similar expiry, the strategy is executed at net debit.

Please be noted that the strategy is likely to derive positive cashflows regardless of the underlying spot FX moves with more potential on the downside (please also be noted that the tenors shown in the diagram are just for demonstration purpose, use accurate tenors as per the requirements).

Currency Strength Index: FxWirePro's hourly AUD spot index is flashing at 3 levels (which is absolutely neutral), while hourly NZD spot index was at shy above 53 (bullish) while articulating (at 09:12 GMT). For more details on the index, please refer below weblink:

http://www.fxwirepro.com/currencyindex.

FxWirePro launches Absolute Return Managed Program. For more details, visit:

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch