The Fed meeting staged no major fireworks in FX beyond the initial knee jerk. Oil markets are remaining quite jittery with the overall setup so far supportive of petro currencies. We argue that such backdrop should keep a lid on petrocurrencies selloffs, if any, and by extension pose a unique opportunity for fading rich USD/petro skews (i.e. firm oil should put downside pressure and/or suppress USD/ccy up moves).

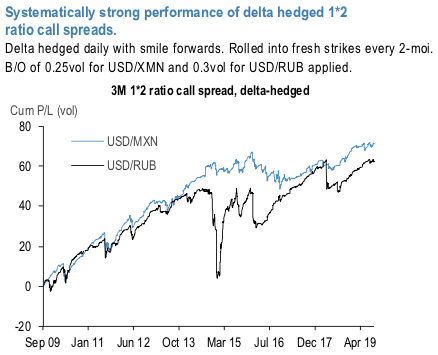

In the past we discussed USD/high beta put ratio spreads which are set up as net short vol structures on safe side of the skew and tend to exhibit attractive Sharpe ratios but are slow in harvesting P/L. This week bounce in oil, which according to our analysts should stick for longer, provides fertile environment to more aggressively collect skew theta in such pairs as USDMXN and USDRUB, via outright selling of risk reversals (more risky proposition considering that trailing spot-vol correlations have been performing) or via our preferred 1*2 ratio call spreads, delta-hedged. The1*2 ratio call spread structure is still exposed to blowups (left tail risk), thus tactically appropriate only as long as the petrocurrencies remain well anchored by the recent oil supply shock.

The 1st chart shows systematically strong performance of delta-hedged 1*2 ratio call spreads outside of the left tail episodes which hit RUB on a number of occasions (devaluation, sanctions, global risk offs).

The analysis in 2nd diagram shows that 1*1.5 and 1*2 structures capture the bulk of the Sharpe Ratio benefits. We assess the performance over last 10 year period, inclusive of the risk off episodes. Going further out and reducing relative weight on the long vol (nearer strike) leads to diminishing of the built-in protection of the ratio call spread structure during the risk off episodes resulting. Overall, 1:1.5 to 1:2 are the sweat spot among the 1*N ratio call spread structures. Hence we consider:

Sell 3M USD/MXN 25D risk reversal, delta-hedged @2.05/2.3 indic

or as a safer alternative:

Own 3M USD/MXN ATM/25D 1*2 ratio call spread @10.15ch vs @11.4/11.65 indic, delta-hedged, in vega notionals. Courtesy: JPM

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty