We quickly run you through short trade baskets and driving forces of EUR bloc especially on geopolitical turmoil and poor growth.

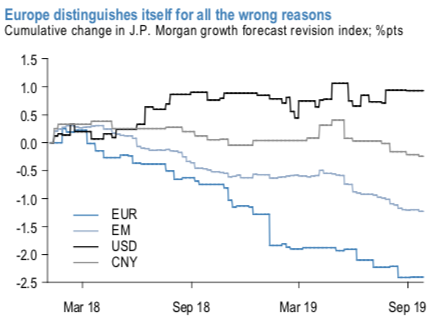

The focus on the poor US survey data this week should not detract from the ongoing and increasingly chronic underperformance of the Euro area economy (refer 1st chart).

We believe this will necessitate the ECB taking out additional monetary insurance in December (another 10bp off rates and an additional €10bn in monthly QE) and that this should serve to maintain the steady downtrend in EUR and slightly more dynamic downtrend in those regional currencies including the Scandies that are highly levered to regional growth (refer 2nd chart).

While the orders received by German industry in August fell by 0.6% compared to the previous month, which is more than expected. Leading indicators such as Ifo expectations also indicate that the downward trend in German industry is likely to continue.

On geopolitical front, the news from Brussels and London yesterday must have caused even the most persistent optimist to abandon hope. According to the news the German chancellor told her British colleague Boris Johnson in no uncertain terms that it would be inacceptable for Northern Ireland to leave the EU customs union, meaning his proposal for the Irish border was inacceptable. The British government and particularly the Northern Irish DUP, whose votes the government depends on, then made it clear that in view of these demands an agreement was nigh on impossible.

As a result Sterling eased significantly, but not as significantly as to assume that the majority of market participants now expect a no-deal Brexit to happen. EUR-GBP is still trading at too large a distance to this year’s highs for that to be the case. That is likely to be due to the fact that the majority of market participants, including those that had so far expected a deal, now banks on a further postponement of the Brexit date, as the House of Parliament had passed legislation for exactly this case of failing negotiations, forcing the government to take this step.

Trade tips:

Add longs in 3m EURJPY put spread (116.75/113.75). Paid 0.56% at the end of September. Marked at 0.63%.

Add longs in USDSEK from 9.7617 at the end of September. Marked at +1.01%.

For EURGBP, 3-way options straddle versus ITM calls are advocated seem to be the most suitable strategy for EURGBP contemplating some OTC sentiments and geopolitical aspects.

The strategy comprises of at the money +0.51 delta call and at the money -0.49 delta put options of 2m tenors, simultaneously, short (1%) ITM puts of 1w tenors. The strategy could be executed at net debit but with a reduced trading cost. Courtesy: JPM

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data