The release of Canadian national accounts showed a 0.8% (annualized) gain in Canadian real GDP in Q4, slightly better than the zero print expected by markets.

Stripping away net trade, final domestic demand fell by 0.6% in the quarter.

The good news stories were in the forward looking indicators:

Monthly real GDP grew by 0.2% in December, providing a nice hand-off into the Q1 2016.

Real exports in January grew 2.5%, and net trade is poised to provide a significant boost to economic growth.

While, Canada's seasonally adjusted current account deficit printed at CAD 15.4 billion in the Q4 2016 which is lesser than forecasted at -15.60 billion. A lower deficit on trade in goods was offset by a higher gap on investment income.

The better-than-expected economic turnout in the end of the year is likely to keep the Bank of Canada on hold at next week's interest rate decision.

Technical glimpse: Ahead of monetary policy season in Canada and Eurozone, we see more volatility and downside potential in Euro Canadian cross as the bulls could not hold onto the recent peaks of 1.5914, it's been tumbling further after breaches below neckline at 1.5100 and claims more dips breaking important supports at 1.4949 levels to signify more weakness with both leading and lagging indicators to converge this selling pressure. Hence, we could foresee southward journey, probably below 1.45 sooner.

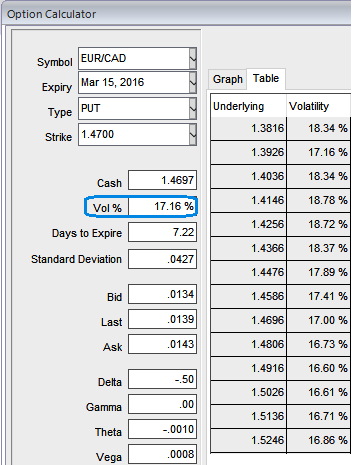

Hedging Idea: When we are strategising hedging frameworks, we came across the implied volatility of EURCAD ATM contracts of 1W expiries are spiking higher than 17% (17.16% to be precise),

The hedging rationale: Capitalize on the potential downswings when IVs are spiking higher

Strategy: Longs in ATM 50% delta put contracts.

Why ATM delta puts: Unlike a short in the spot FX whose value per pips stays the same, the value of an option for every point's movement in the underlying is constantly changing. The Delta can be used to measure the value of an option as the market moves. This is useful to monitor directional risk so you may know how much your option's value will increase or diminish as the underlying market moves.

How does it work: Compared to short selling in spot FX, it is more convenient to bet against the pair by purchasing put options as the investor does not have to borrow the spot outrights to settle the shorts.

Additionally, the risk is capped to the premium paid for the put options, as opposed to unlimited risk when short selling the underlying spot FX of EURCAD outright.

However, put options have a limited lifespan. If the spot price does not move below the strike price before the option expiration date, the put option will expire worthless.

But, here the implied volatility is an important factor to be considered in options trading, because the prices of options are directly affected by it. A security with a higher volatility will have either had large price swings or is expected to.

FxWirePro: Trade balance and GDP keeps BoC on hold and to fuel CAD's gains - hedge EUR/CAD risks via ATM delta instruments

Tuesday, March 8, 2016 12:27 PM UTC

Editor's Picks

- Market Data

Most Popular

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary