The tariff rattling in the trade war continues. China’s announcement to impose tariffs on US goods amounting to USD 50bn caused notable insecurity on the FX market. Initially, analysts had expected that China’s countermeasures would not fully match the US tariffs on Chinese products.

Was the strong reaction the cause of more conciliatory tones from the US administration later on that calmed exchange rates during the course of the day? Donald Trump’s new economic advisor Larry Kudlow underlined just like Secretary of Commerce Wilbur Ross, that the US was still hoping to negotiate and that the tariffs had not yet been implemented. The uncertainty as to what will happen next will remain though and according to the President of the St. Louis Fed James Bullard this might have an effect on the Fed. Bullard, who has no voting rights this year, pointed out in his speech yesterday that interest rates might remain low due to the increased uncertainty.

So does the current development in the trade war point towards a weaker dollar due to a more cautious Fed? That is unlikely. Yes, we assume that the demand effects that support real USD appreciation as a result of unilateral US tariffs will be compensated for by the Chinese countermeasures.

Technically, as stated in our previous post, the underlying FX pair EURUSD has been oscillating between a tight range of 1.2575 and 1.2150 levels even though the intermediate trend has been bullish, while the flurry of bearish indications is lingering around the corner (refer weekly chart).

Well, all these fundamental and technical developments are factored in EURUSD OTC markets.

Option Strategy: Options straddle

Combination ratio: (1:1)

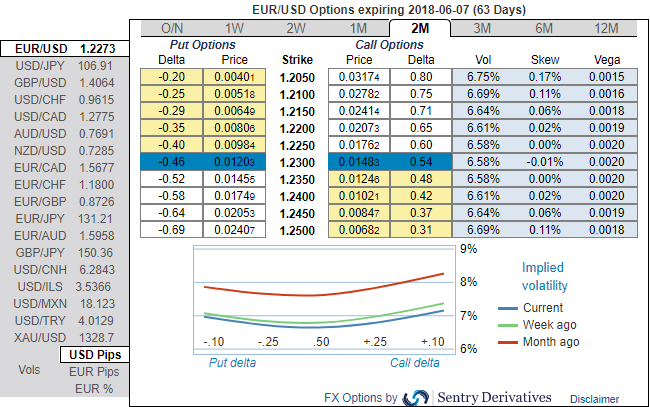

Rationale: Contemplating above mentioned technical environment, and ATM implied volatilities of 1m expiries are below 7% which is on the lower side among G7 currency segment (2nd least after EURGBP) and hence, likely bounce back.

Let’s glance at bullish neutral risk reversals that indicate tepid hedging sentiments in next 1m time. Whereas hedging sentiments seem well balanced on either side if you have to glance through the sensitivity tool, the positively skewed IVs are stretched on both OTM calls and OTM puts in 1m timeframes.

In addition to that, let's glance on OTM strikes, %change in premiums and %probabilities in hitting these strikes on expiration that keeps us eyeing on shorting expensive calls with shorter expiries in conjunction with ATM straddles.

Based on this rationale, cautious hedgers can initiate the below-stated options strategy. In order to arrest both this upside and downside risks that are lingering in short-term trend, we recommend deploying options straddle strategy.

The execution:

Go long in EURUSD 1M at the money delta put, go long 1M at the money delta call and simultaneously.

Margin requirement: No.

Description: Trade the expectation of increased volatility without taking a view on any particular direction. A strategy usually utilized over significant economic data events and other political events.

Effect of Volatility: Directly proportionate to the volatility, the value of both options premiums would likely to enhance as volatility increases (good) and will decrease as volatility falls (bad).

FxWirePro launches Absolute Return Managed Program. For more details, visit:

Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays