Even though the Bank of Canada (BoC) never seemed overly fretful about an end of NAFTA it is nonetheless likely to have breathed a sigh of relief when the new USMCA deal was all sorted out. One risk less, apart from that everything seems to be going to plan for the BoC at present. The economy is humming, the unemployment rate continues to fall with moderate wage growth, as the recent labour market report on Friday proved, and the various measures of core inflation are in the middle of the target range.

The overall rate on the other hand is almost touching the upper limit. That means the BoC can continue with its rate hike cycle. On 24thOctober, it will once again hike the key rate by 25bp to then 1.75%.

However, this step is almost entirely priced in, so that this is likely to cause only limited up- side pressure for CAD. What will probably be more important is whether the BoC is planning to accelerate the cycle or to extend it. At least the market can now once again fully concentrate on this matter, now that the USMCA agreement has been reached, so that wage and price data in particular is likely to become more important for CAD once again.

Canada can rely on important allies in the US: in Congress, where all trade agreements have to be ratified, resistance is forming against an agreement between the US and Mexico, excluding Canada. This strengthens the Canadian negotiating position but also increases the risk of a possible failure of the negotiations. The resulting risk premium is putting pressure on the Canadian dollar. Further losses are possible unless an agreement emerges.

OTC outlook: Well, before we proceed further to the core part of our strategies, let’s just quickly glance through OTC outlook of USDCAD.

All these driving forces seem to be factored-in OTC markets. Please be noted that the positively skewed IVs of 2m tenors signify the hedgers’ interests to bid OTM call strikes upto 1.32 levels (refer above nutshell evidencing IV skews).

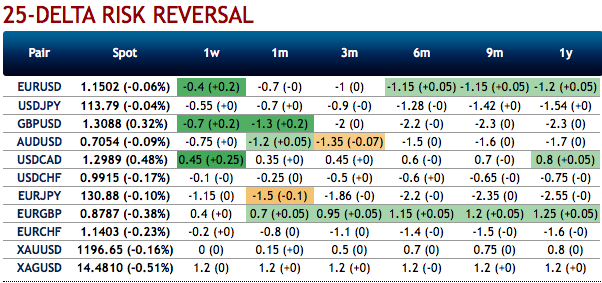

Positive bids of risk reversal (RRs) of 1w USDCAD is also signalling bullish risks in the near-terms (refer above nutshell showing risk reversals). A risk reversal is an over-the-counter (OTC) structured forward that is predominantly utilized as a hedging solution. The bullish RRs propose the probability of benefiting to a limited extent from an appreciation of the foreign currency you are exposed to.

Options Trade Strategy: Contemplating above factors, debit call spreads are advocated as the buying indications are piling up in near-terms.

Execute strategy by buying 2m (1%) in the money 0.69 delta call option and short 2m (1%) out of the money call option for net debit. The strategy can be executed at net debit.

Thus, shorting an out of the money call option is recommended to reduce the cost of hedging by financing long position of in the money call option.

Currency Strength Index: FxWirePro's hourly CAD spot index is inching towards -100 levels (which is bearish), hourly USD spot index was at 4 (neutral), while articulating (at 12:46 GMT). For more details on the index, please refer below weblink:

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch