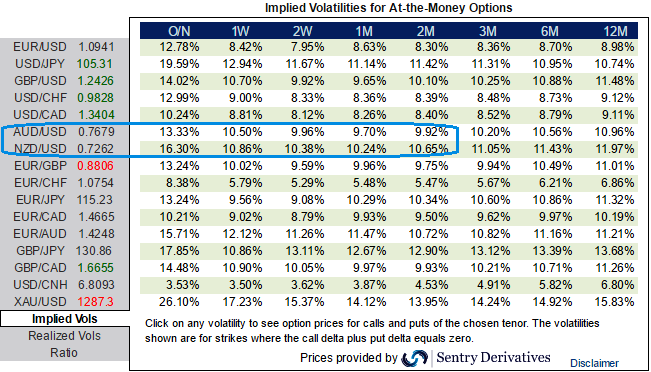

The narrow-dated forward vols in antipodean currencies are priced highly asymmetrically with respect to a rolling history of 1M ATM vol.

For instance, the above chart explains that indicative offers on 1M1M FVAs in NZDUSD are near historical lows in 1M ATMs over the past 2-years, implying asymmetric upside to longs should the present inertia in option markets be rudely interrupted by a Trump victory yesterday; the set-up is similar for AUDUSD and AUDNZD as well. You could very well observe that in the massive shrink in IVs of NZDUSD and AUDUSD across various tenors.

The unexciting contours of the antipodean macro story are partly to blame for the comparatively low election day-weight priced into AUD and NZD vols, with currency resilience underpinned by marginal improvements in terms-of-trade dynamics and policy rates that are on flat or shallow easing tracks already baked into rate expectations.

The other factor behind such low forward vol numbers is that the 1-month forward window spans the December holiday season which tends to be a quiet period in markets.

While indubitably true, we reckon that there is enough cushion built into current FVA prices to stomach an aggressive rolldown of 1M vols if the elections turn out to be a non-event, such that their payout profile is asymmetric, but a meaty 2-3 vol MTM in the event of a Brexit-like shock.

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms