From last 2 weeks, USDJPY bull trend remains stuck in an 117-118.500 range (we’ve seen the non-directional trend and shrinking bullish momentum in our recent technical write up).

Thus, we continue to foresee the sideways trend likely to prolong and evidence slight dips.

On the data front, we see no significant data releases in both continents except US unemployment claims due to X’mas and New Year vacation that could propel the underlying.

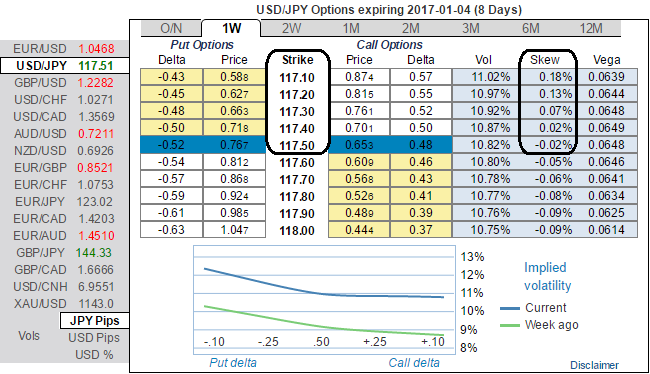

ATM IVs of this pair is trading a tad below 10.5% for 1w tenors as the sideway trend likely to persist. While positively skewed IVs in 1w tenor signifies the option markets interests in out of the money puts, which would imply that hedging sentiments still remain on downside risks despite the bulls attempt of spiking above from last two months.

Hence, the long put butterfly spread is advocated on speculative grounds that fetches the limited returns and carries the limited risk.

As shown in the diagram, one can initiate this strategy with three distinctive strikes and it is constructed by buying one lower striking put, writing two at-the-money puts and buying another higher striking put of similar expiries for a net debit.

The execution: Buy (1%) 1m in the money put option, short 2 lots of 2w at the money put options, simultaneously; buy one more (1%) 1m out of the money put option. We keep narrowed expiries to gain the advantage of time decay.

The strategy is to be executed if the FX options trader thinks that the underlying spot FX would not spike or drop much dramatically on expiration.

The maximum return for the long put butterfly is achievable when the USDJPY spot remains unchanged as stated in above range at expiration. At this price, only the highest striking put expires in the money.

The maximum loss for the strategy is limited to the extent of initial debit taken to enter the trade plus commissions.

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand