The Turkish lira has entered another perfect storm, as shaky macro fundamentals are eroded by the bullish crude oil price, weak emerging market sentiment and the returning personal grip of President Recep Erdogan on the economic processes, TRY and monetary policy.

The markets continue to dislike this kind of interference, now pricing extremely high TRY hedging. We expect the TRY sell-off to calm down if the President announces a fiscal austerity programme and signals more central bank independence.

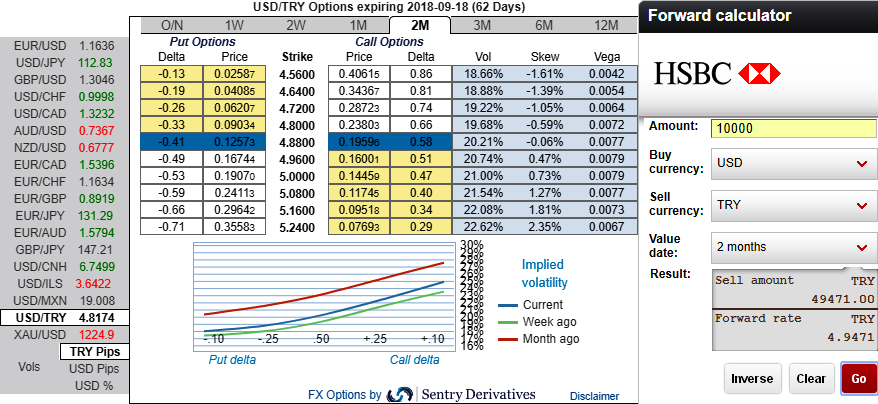

In the near term, even though USDTRY likely to slide down a bit from the current levels, updating the forecast as follows: 4.80 in 1M, 4.90 in 2M, 5.20 in 4M and 5.10 in 6M.

While we hold off moving UW with the CBRT surprising once again. The aggressive 500bps of tightening cumulatively delivered since April 25th is supportive for the currency in the first instance, however, we see a portion of it as merely “catching up”, with inflation accelerating.

Please be noted that the positively skewed IVs and forward rates of 2m tenor indicate mounting bullish risks which are in line with above projections (refer above nutshell for IV skews and forward rates).

At spot reference: 4.8167 levels, contemplating above driving factors, on hedging grounds we initiate 2m USDTRY ATM +0.51 delta call options.

Currency Strength Index: FxWirePro's hourly USD spot index has shown 55 (which is bullish) while articulating at 14:05 GMT.

For more details on the index, please refer below weblink:

China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure