The office for National Statistics released UK's preliminary GDP report that is expanded by 0.7% in the Q2 which is in line with forecasts and economy grew from preceding quarter's 0.4%. The pound edged higher against the U.S. dollar on Tuesday, after data showed that the U.K. economy grew in line with expectations in the second quarter, while sentiment on the greenback remained vulnerable ahead of the Federal Reserve's policy statement this week.

On the flip side the weaker retail sales print last week, the GBP has been trading on the back foot. EURGBP has bounced strongly from .6940/30 support, while GBPUSD dropped from 1.5675 resistance. With positioning a little cleaner now after this move, a strong GDP number today has the potential of seeing GBP return to test these key levels. However, it is unlikely to see a major move ahead of the FOMC tomorrow. Strong data may also attract a level of safe haven buying to the UK around China worries.

Long term overview: Sideways or slightly bullish

It has been closely monitored the UK's fundamentals and its currency fluctuations, although the uptrend of GBPUSD looking to struggle but is not fragile.

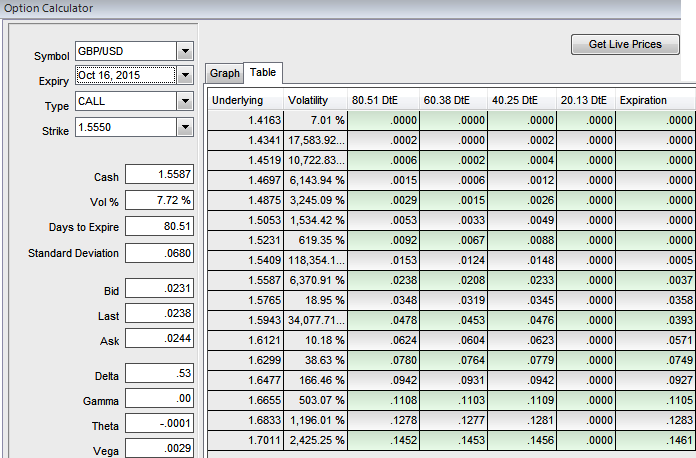

We therefore recommend "call ratio spread" as the pair is likely to remain either sideways or slightly bullish in our view. Buy far month In-The-Money 0.53 delta call option and sell more near month Out-Of-The call option at a higher strike price.

Buying call spread in addition to selling more necked call options constitutes this hedging position. The portion should ideally be constructed in the ratio of 1:2 or 1:3. Use shorter expiry on shorts side and abundant time for long side.

One can get benefitted from probable price falls in coming days by leveraging advantage through shorts side using near month contracts. Breakeven will be at: short strike price + difference in strike price + net credit.

FxWirePro: UK GDP fuels cable upswings; hedge with ratio spreads

Tuesday, July 28, 2015 11:53 AM UTC

Editor's Picks

- Market Data

Most Popular

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings