The current price of EURGBP is trading almost 4 and half months lows at 0.8369 levels after U.K. services activity hits 10-month high in November. The report states, UK service PMIs increased to 55.2 last month from a reading of 54.5 in October which is more than anticipated (forecasts were at 54.2), bolstering optimism over the health of the British economy as the sector makes up approximately 80% of the gross domestic product, industry data showed on Monday.

In a report, market research group Markit said the seasonally adjusted UK service PMIs prints the upbeat numbers of 55.2 last month from a reading of 54.5 in October.

Hedging Framework:

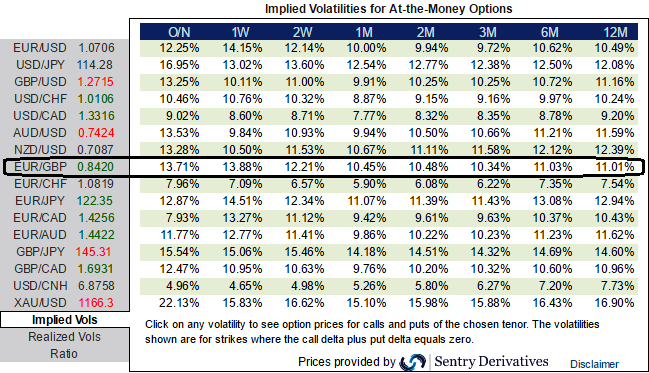

Elsewhere, the EURGBP’s implied volatility is perceived to be rising a tad below 10.5% among the major currency counterparts (3m ATM contracts spiking well above 10.34%). As you can probably make out the negatively skewed IVs that signify the short term interests of upside risks, while the bearish risks are signified by 1m tenors.

While the delta risk reversals have been neutral to indicate hedgers have been cautious but previous sentiments of bullish risks are completely faded away, now that turns into bearish sentiments.

Well, capitalizing on fundamental updates, IV skews, and risk reversal indications, one can execute the option strategies as stated follows:

Snap rallies and buy this 1w1m IV skews and neutral risk reversals that keep FX exposures on tight hedge with reduced costs, it is advisable to construct option strips strategy so as to mitigate the risks on either side using the diagonal expiries.

Hence, to execute this strategy, go long in 2 lots of 1m ATM -0.49 delta puts and simultaneously, add long in 1 lot of ATM +0.52 delta calls of 2w expiry.

In the bottom line, Should the foreign trader reckons that the underlying volatility will likely remain significantly higher in the medium term, then this strategy is advisable, he may even wish to hold on to the long term straddle to profit from any large price movement that may occur.

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data