Today’s GDP figure will be released at 8:30 GMT from the Office of National Statistics (ONS). It is the first flash estimate of the third quarter GDP. The data is of extreme importance as it would represent the performance of the economy over a quarter after the referendum in June.

- The number, however, unlikely to be a key influencing factor for the pound and the FTSE100 as the focus has now shifted to the politics of the referendum. Data, other than GDP figure has already shown that the UK economy has performed better than expected. Retail sales, PMI reports, industrial production; all have been better than expected.

Past trends –

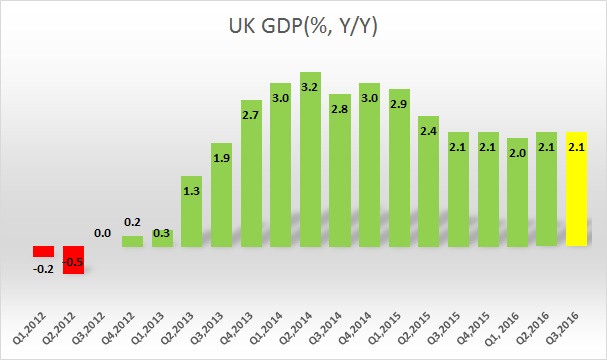

- After the 2008/09 crisis, the UK economy has been growing at the fastest pace among its OECD peers.

- GDP growth reached the highest level in the second quarter of 2014, reaching 3.2 percent growth on yearly basis. Since then growth has somewhat waned. In last quarter of last year, growth was 2.1 percent y/y, same as the third.

- This year, the economy grew 0.4 percent in the first quarter and by 0.7 percent in the second quarter on a quarterly basis.

Expectations today –

- Today, GDP growth is expected at 0.3 percent q/q and 2.1 percent y/y. However, we suspect that the data might outperform expectations.

Impact –

- The pound is currently trading at 1.221 against the dollar. The sterling has reached our forecasted short-term target of 1.2. We have also forecasted for the pound to drop to parity in the longer run.

Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock

U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock  Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals

Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals  Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength

Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength  Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality

Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record

Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record  Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility

Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility