2Y US-Canada yield spreads: We think at this point in time USD/CAD is on upper hands. Spreads have been one of the best depictions of the BoC/Fed divergence theme and should continue to trend in favour of a higher USD/CAD as the Fed approaches its first rate hike.

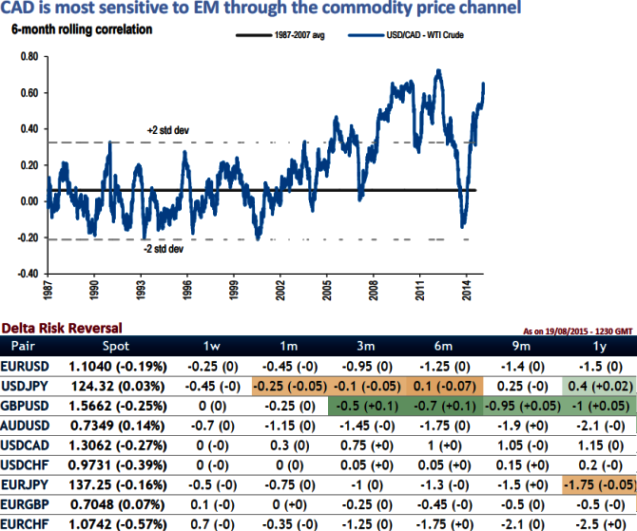

1M 25-delta risk reversals of USD/CAD: These numbers bid for more calls have fallen off again this week and are approaching the lows reached in the aftermath of the BoC. After the move to 1.15, the options market appears to be more bullish on the direction for the pair over the 1m-1y time horizon (refer delta risk reversal nutshell).

The PBoC devaluation of CNY has rightfully dominated market attention this week. Beyond the direct FX and trade effect, the move has elevated worries about the emerging market space more generally. Concerns have been growing on what spillover there might be to the developed world, and here we consider the broader implications for CAD.

We assess that by looking at two potential transmission mechanisms: cross asset correlation and FX volatility. The upshot is that the commodity price channel appears to pose the clearest risk to CAD because more than 70% of Canada's trade is with the US, only a small USD/CAD move is needed to compensate for large moves in CAD/CNY.

FxWirePro: US/Canada 1M delta reversal, 2Y spreads and EM exposure keep CAD at risk

Thursday, August 20, 2015 10:25 AM UTC

Editor's Picks

- Market Data

Most Popular

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate