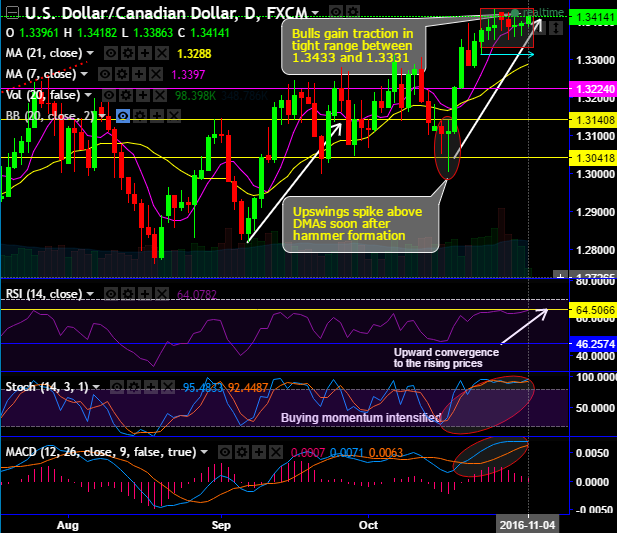

CAD seems to have taken a halt in the tight range between 1.3433 and 1.3331 against USD, while USD bulls gain traction in this tight range (see both daily and monthly plotting).

The current prices are consistently spiking well above DMAs soon after the hammer formation breaking major resistances at 1.3140 and 13224 levels.

For now, the breach above exposes more upside potential due to more bullish momentum offered by leading oscillators.

On a broader perspective, as you can probably make out from monthly plotting, the pair has taken supports at 1.2561 levels in May series and since then continuing its major uptrend to resemble a handle pattern in conjunction with the saucer pattern earlier.

Both leading oscillators signal buying interests, as RSI (14) evidences a bullish convergence with the rising prices above 64 levels after testing support at 46 levels multiple times, so we believe there has been buying sentiments atleast in the medium run.

While stochastic has been quite decisive to signal momentum in this buying sentiment but slightly bullish bias.

We could see more alarms for bears as the pair bullish momentum is clear for the day.

If these rallies continue to persist for few weeks then we could foresee handle pattern in coming months. Hence, one can initiate longs amid this bullish environment.

Trade tips:

Contemplating money management skills in mind that keeps any trader on a competitive edge, it is wise to choose the right asset avenue to stay invested for more returns than usual, (for instance, wouldn’t you be happy to gain 10 times than 1 time when your research turns out to be accurate).

Well, on speculative grounds, we recommend buying rallies and decide to initiate one touch call options which are highly leveraged products. Since 1W implied volatility is on the higher side at around 14.5% in a robust bullish environment, we recommend this long vega strategy.