After testing the parity on a stronger dollar, the Swiss franc has strengthened steadily over the 5 weeks or so, and our calculations suggest that the franc might keep heading to the north towards 0.96 area against the USD. USD/CHF is currently trading at 0.988 area.

We expect that a relatively weaker dollar would continue to provide the necessary weakness for the USD/CHF pair to slide. It was interesting to note that during the recent Italian political crisis, whereas euro was sliding fast against the USD; franc was positive on the dollar as it received safe haven flows from EU. So the ongoing uncertainty in the EU is likely to be positive for the USD/CHF to slide.

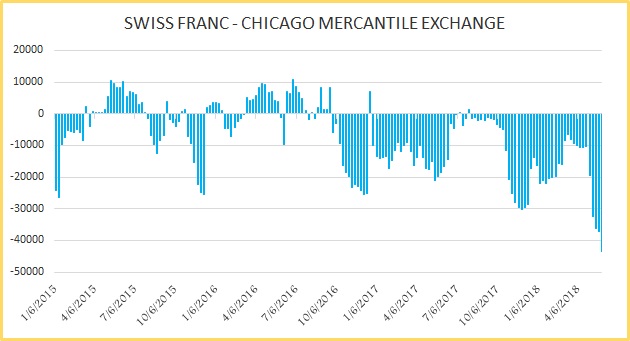

However, the strength in the USD/CHF comes in contrast to two fundamentals, shown in the above two charts; the first one is Swiss franc’s commitment from traders report, which shows that the net speculative position has spiked to record short. The second chart plots USD/CHF against 2-year interest rate spread between the two countries, which shows that the spread has reached well over 3 percent in favor of the USD.

FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX