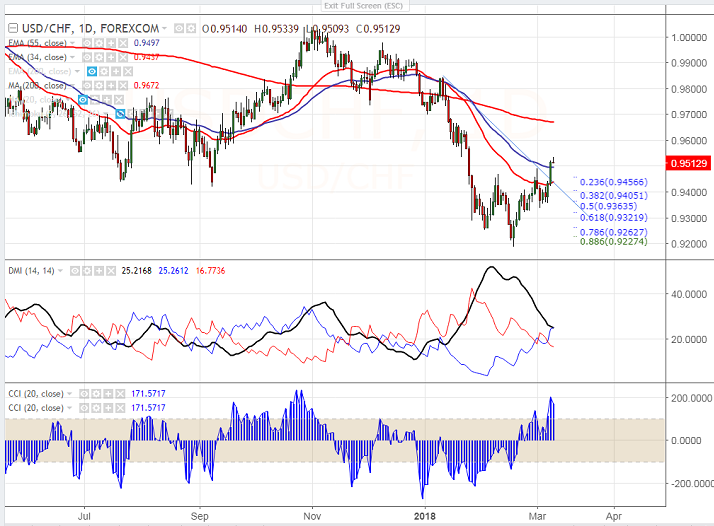

- USD/CHF has shown a good recovery almost 100 pips after hitting low of 0.94213. The pair formed almost minor bottom around 0.9350 and any bearish continuation can be seen below that level. The pair hits previous week high of 0.94899 and is currently trading around 0.95174.

- Swiss Franc weakens after ECB monetary policy meeting. The central bank said that it will bond buying program will continue till Sep and longer if needed. It has not given any specific end date. Traders are awaiting an announcement from US president Trump on tariffs. Market eyes US Non farm payroll for further direction.

- Technically, in the daily chart the pair is facing strong resistance at 0.9550 and any break above will take the pair to next level till 0.9600/0.9620./0.96650.

- On the lower side, near term support is around 0.9430 (34- day EMA) and any break below will take the pair to next level till 0.9380/0.9350. The major support is around 0.92510.

It is good to buy on dips around 0.9495-50 with SL around 0.9430 for the TP of 0.9600.