The US-Chinese trade negotiations were not exactly simple so far, but now the whole thing is getting even more complicated. After the House of Representatives almost unanimously passed the Hong Kong Bill that envisages sanctions against China should the status of Hong Kong as a special administrative region be under threat the trade negotiations have become almost inseparable from the events in Hong Kong.

On the other hand, Chinese President Xi Jinping broke his silence on trade talks, and says that Beijing wants to work for a trade deal with the United States but is not afraid to "fight back" to protect its own interests. “We want to work for a ‘phase one’ agreement on the basis of mutual respect and equality,” Xi said. However, President Trump later responded: “I told President Xi, ‘This can’t be like an even deal. We’re starting off from the floor and you’re already at the ceiling'.” Such rhetoric indicates that there is little chance that both sides could find a balancing point any time soon, although China is making some progress on intellectual property protection as over the weekend the government announced some new measures to improve the IPR process.

However, the sticking points remain as China does not want to commit a specific amount of farm goods purchase and the US is reluctant to roll back existing tariffs. For the FX markets, neither "good news" nor "bad news" have big impact for now. It seems only "breaking news" can move the market.

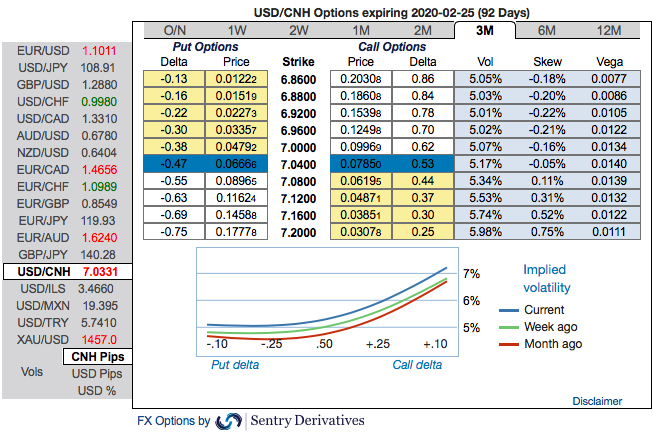

Amid such a geopolitical turmoil, although USDCNH has resumed its bull-run from last week or so, and the pair has jumped above 21DMAs but for today little edgy, trading at 7.0332 levels.

Trade Strategy: At this juncture, we remain short in CNH via 3-month (7.00/7.25) debit call spread. If the scenario outlined above unfolds, we will re-assess our stance but at the moment there are no changes to our CNH recommendations. The positively skewed IVs of 3m tenors indicate that the upside risks of USDCNH are foreseen, OTM call bids up to 7.20 (refer above chart, spot reference: 7.0332 levels). Courtesy: Sentrix & Commerzbank

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics