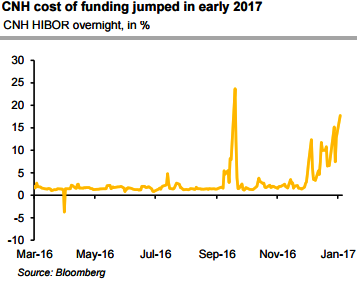

What occurred at the start of 2017 evokes the market anarchy in early 2016. This morning, Chinese offshore currency (CNH) overnight HIBOR spiked to 18.5%, a signal that China’s currency is under great pressure again. Liquidity tightening is a typical phenomenon when the currency is facing huge sell-off pressure – people borrow one currency and short, which pushes up the cost of funding.

Of course, the intervention from the central bank, if there is, will tighten the CNH liquidity as well. There is no doubt that China still faces strong capital outflows, and the reactions from Chinese authorities are to tighten the capital control measures.

This won’t sort out the problems fundamentally, as the root reason of capital outflows is the extremely expensive domestic asset prices and poor real returns of these assets.

In fact, the Chinese authorities have realized this issue and have turned its policy focus to “bubble deflating” in the coming year. This makes sense, but short-term pain is inevitable.

One should clearly understand that the recent upmove in USDCNY is largely a reflection of USD strength rather than CNY weakness. USDCNY appreciated in line with broad USD appreciation. US officials cannot reasonably claim that China is deliberately weakening CNY. A simple comparison between USDCNY and the CFETS RMB index shows that during October and November the weighted basket remained effectively flat, whereas USDCNY appreciated in line with broad USD appreciation.

On the contrary, any abrupt CNY appreciation is only deemed as the effects of the selling FX reserves to prevent severe CNY weakness.

CNH Option strategies on hedging grounds:

Buy USDCNH 1y topside seagull, strikes 6.90/7.20/7.50, zero cost (indicative, spot ref: 6.95), the structure is a standard 1y call spread strikes 7.20/7.50 fully financed by selling a put strike 6.90, exposed to a maximum USDCNH appreciation of 4.2% at expiry.

Buy USDCNH 1y call spread strikes 6.90/7.80, (spot ref: 6.9268) This longer-term trade positions for further CNH depreciation, generating a maximum leverage close to 6 times beyond 8.00 in one years.

Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty

Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook

BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand