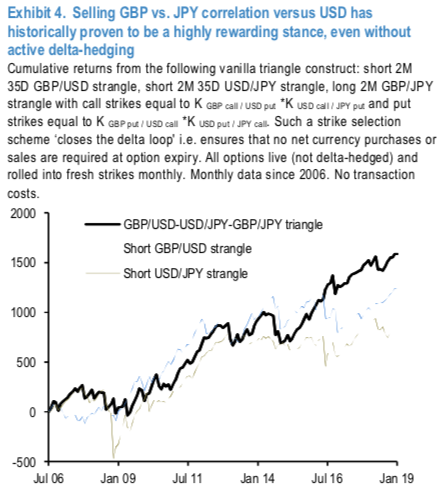

Last week, we entered into a GBP call/JPY put spread vs. USD call/JPY put spread as a low premium expression of GBP bullishness against the backdrop of sharply lower odds of no-deal Brexit. Aside from the directional exposure it provides, the other notable feature is the embedded short USD-correlation risk of the option spread – it benefits from de-coupling between GBPUSD and JPYUSD, in this instance via GBP strength and JPY weakness against the greenback – that has historically proven to be a highly rewarding stance to hold. Consider Exhibit 4 that plots cumulative returns from selling GBP vs. JPY correlation via USD executed via a short GBPUSD – short USDJPY – long GBPJPY 2M 35D vanilla strangle triangle (all options live i.e. no delta-hedging). Steady return accumulation from a net option selling/premium collecting construct is not surprising in and of itself; the eye-catching aspect of the graphic is the relative absence of the large drawdowns that characterize short option strategies, especially around the GFC carnage. For comparison, both the individual USD- legs in Exhibit 4 exhibit periodic large drawdowns that lead to markedly lower risk-return metrics over the sample period in question.

In the current Brexit context, the comforting takeaway is that our directional option spread structure is correctly positioned in terms of correlation risk. From a non-directional relative value standpoint, the option triangle in Exhibit 4 can also function as a viable low-touch theta collecting construct. In fact, USD-GBP-JPY ranks as one of the best correlation trios to consider within the universe of such trades within USD/G10 (Exhibit 5). Courtesy: JPM

Currency Strength Index: FxWirePro's hourly GBP spot index is flashing at -97 levels (which is bearish), hourly USD is at 27 (mildly bullish), hourly JPY spot index was at 50 (bullish) while articulating at (11:11 GMT).

For more details on the index, please refer below weblink: http://www.fxwirepro.com/currencyindex

China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges