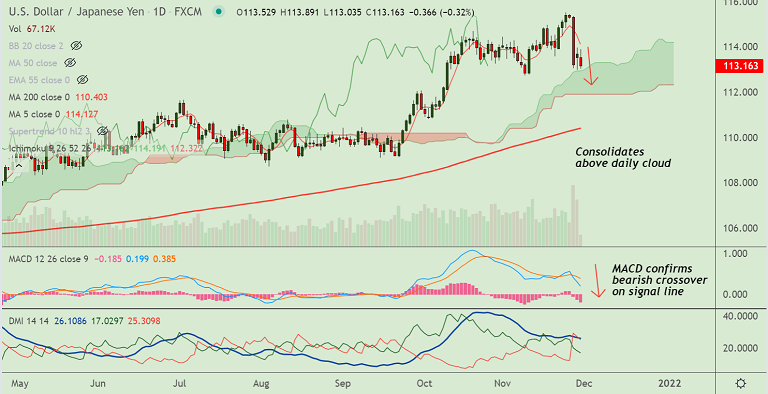

Chart - Courtesy Trading View

Technical Analysis: Bias Bearish

GMMA Indicator

- Near-term moving averages have turned bearish on the daily charts

- Near and long term moving averages are strongly bearish

Ichimoku Analysis

- Price action is consolidating above the daily cloud

- Chikou span is biased lower and may drag the pair lower

Oscillators

- Stochs and RSI are sharply lower, RSI is below the 50 mark

- Momentum is strongly bearish on the daily charts

Bollinger Bands

- Bollinger bands are wide suggesting high volatility

Major Support Levels: 113.06 (55-EMA), 112.93 (Cloud top)

Major Resistance Levels: 114.13 (5-DMA), 114.44 (200H MA)

Summary: USD/JPY trades with a strong bearish bias. Price action is currently consolidating above daily cloud. Break below cloud will drag the pair lower.