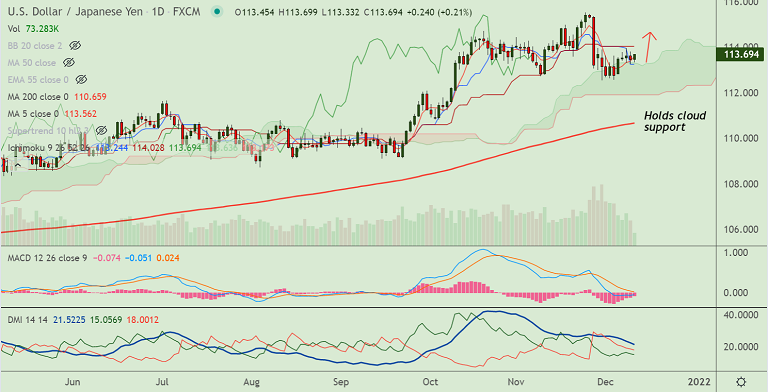

Chart - Courtesy Trading View

USD/JPY was trading 0.21% higher on the day at 113.69 at around 10:30 GMT.

The pair is extending sideways grind above daily cloud support, bias remains tilted towards the upside.

Dips in price action has held above 200H MA support, breach below will see more weakness.

The major remains capped between 21 and 55 EMAs, breakout will provide a clear directional bias.

Hawkish Fed expectations keep the dollar supported ahead of today’s key US Consumer Price Index (CPI).

US Consumer inflation is forecast to accelerate to 6.8% annually from 6.2% in the previous month. While, core CPI is expected to rise to 4.9% from 4.6%.

Technical indicators also support gains. Break above 21-EMA could add to the bullish bias. Next major resistance for the bulls lies at 113.91 (20-DMA).