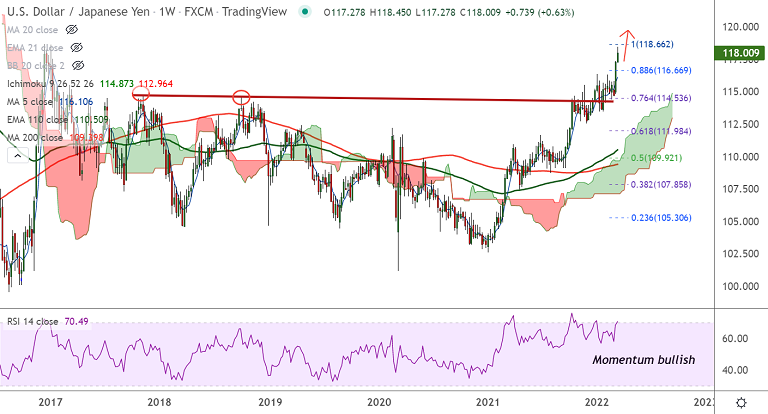

Chart - Courtesy Trading View

USD/JPY was trading 0.18% lower on the day at 117.97 at around 13:05 GMT.

The pair erased early gains and slipped into the red after NY Fed's Empire State Manufacturing Index missed expectations by a wide margin.

Empire State Manufacturing Index declined to -11.8 in March from 3.1 in February, missing the market expectation of 7.25.

The greenback stays under pressure across the board after the report. DXY was down 0.35% at 98.74 at the time of writing.

Further on the data front, US Producer Price Index (PPI) rose to 10% year-on-year in February from 9.7% in January, in line with expectations.

Annual Core PPI edged higher to 8.4% from 8.3% but this print came in lower than analysts' estimate of 8.7%.

USD/JPY trades with a bullish technical bias. GMMA indicator shows major and minor trend are bullish.

Oscillators are at overbought levels, which may cause some pullbacks. Volatility is high. Pullbacks if any are likely to be shallow.