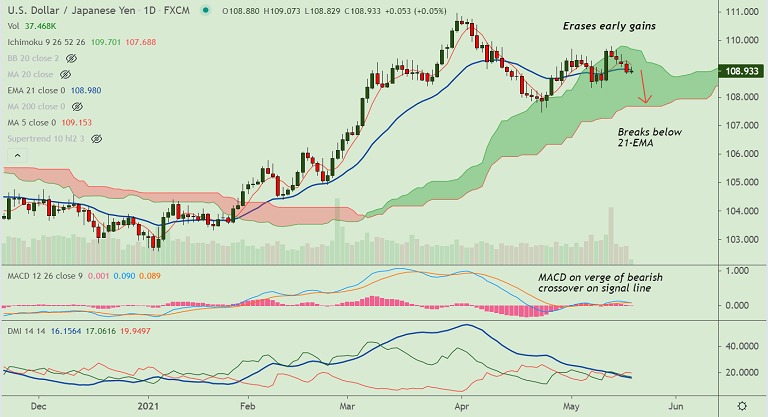

USD/JPY chart - Trading View

Pre-FOMC minutes caution trading weighs on the pair, keeping it rangebound, while the US dollar attempts a tepid bounce.

USD/JPY was trading largely unchanged on the day at 108.91 at around 04:30 GMT, down from session highs at 109.07.

Bank of Japan (BOJ) Governor Haruhiko Kuroda noted that Japan's economy remains under pressure from state of emergency curbs.

Kuroda in his speech on Wednesday said that the central bank will continue to patiently sustain powerful monetary easing.

Focus on the release of minutes from the Federal Reserve’s April policy meeting to gauge the market sentiment.

Markets reeling under broad risk-aversion, as inflation concerns haunt markets. Any hint of tapering measures could dampen the market sentiment further.

Technical bias for the pair is showing a bearish tilt. Price action has slipped below 21-EMA and 5-DMA is biased lower.

MACD is on verge of bearish crossover on signal line and price action has slipped below 200H MA. Scope for further downside. Next major support lies at 55-EMA at 108.45.