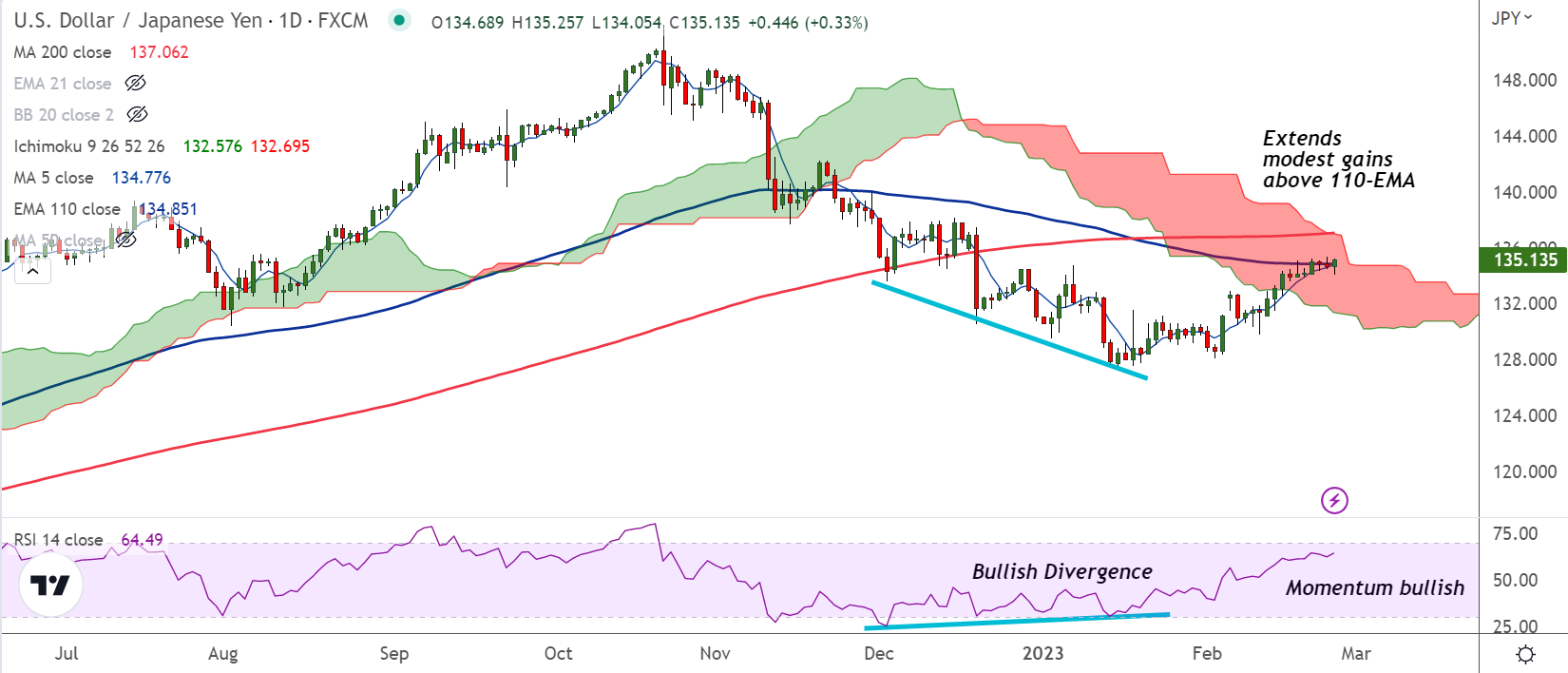

Chart - Courtesy Trading View

USD/JPY was trading 0.33% higher on the day at 135.12 at around 10:35 GMT, technical bias remains bullish.

The dollar index inched higher as investors braced for U.S. interest rates to be higher for longer after a set of strong U.S. economic data.

While on the other side, the yen fell after incoming Bank of Japan Governor Kazuo Ueda said it was appropriate to keep ultra-loose monetary policy.

Ueda, who was nominated earlier this month in a surprise move, warned that uncertainties regarding Japan's economic recovery remained "very high", warranting the BOJ maintaining its ultra-loose monetary policy.

That said, data on Friday showed Japan's annual core consumer inflation hit a fresh 41-year high of 4.2% in January, keeping the central bank under pressure to phase out its massive stimulus programme.

January’s personal consumption expenditures price index - the Fed's preferred inflation measure - due at 13:30 GMT

Focus now on the release of the U.S. personal consumption expenditures (PCE) price index for January, due at 13:30 GMT, for further direction.

The PCE index, the Federal Reserve's preferred inflation measure, is expected to rise up to 0.4% month-on-month, compared with 0.3% rise in the previous month.

Technical bias for the pair is bullish. price action is inside daily cloud and has edged above 110-EMA resistance.

Momentum is bullish and volatility is high. MACD and ADX support gains. Scope for test of 200-DMA and break above will propel the pair higher.

Support levels:

S1: 134.19 (200H MA)

S2: 133.38 (55-EMA)

Resistance levels:

R1: 136.43 (Upper BB)

R2: 137.06 (200-DMA)

Summary: USD/JPY trades with a bullish bias. Scope for test of 200-DMA at 137.06. Rejection at 110-EMA negates any upside in the pair.