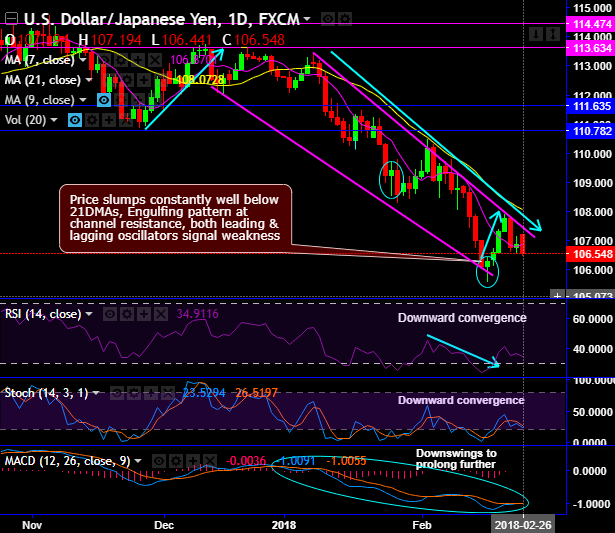

Chart pattern: USDJPY price slumps constantly remained well below 21DMAs despite recent mild rallies (see the yellow line on daily plotting). Ever since the hammer pattern has occurred at 106.272 levels that have shown mild upswings today.

The minor trend of this pair has been sliding through sloping channel pattern.

The bearish engulfing pattern has occurred at 106.742 levels which is exactly at channel resistance. The bearish pattern has now evidenced the considerable price slumps below 7DMA again.

Both leading & lagging oscillators signal weakness (refer daily chart).

While on the broader perspective, ever since the price slid below 7EMA, the candle with the big bearish real body has occurred to evidence steep dips below EMAs.

Consequently, with prevailing intensified bearish momentum, the bears have managed to breach below long lasting range & also breaches 38.2% Fibonacci level, both leading & lagging indicators on this timeframe as well signal weakness.

Strong support zone is observed at 107.272 areas (i.e. 38.2% Fibonacci retracement), we’ve seen the strong demand zone at this juncture couple of times in the recent past which would now act as a strong support. Now, this is broken decisively.

Thereby, you could observe that the momentum in the prevailing bearish swings is building up.

Both RSI & stochastic curves are converging downwards on monthly and signaling selling pressures on the major terms.

Trading tips: Contemplating above technical rationale, we advocate buying tunnel spreads with upper strikes at 107.194 and lower strikes at 106.104, this strategy is likely to add magnifying effects to the yields as long as the underlying spot FX keeps dipping below but remain above lower strikes on expiration. Alternatively, one can short futures contracts of mid-month tenors with a view to arresting further downside risks.

Currency Strength Index: FxWirePro's hourly USD spot index has shown -110 (which is bearish), while hourly JPY spot index was at 109 (bullish) while articulating at 07:29 GMT. For more details on the index, please refer below weblink:

http://www.fxwirepro.com/currencyindex.

FxWirePro launches Absolute Return Managed Program. For more details, visit: