As the Fed will likely to remain on the sidelines on March 16th and so does BoJ, as a result we see tight tug of war between bulls and bears of USDJPY but both prefer to be in sideways in the end.

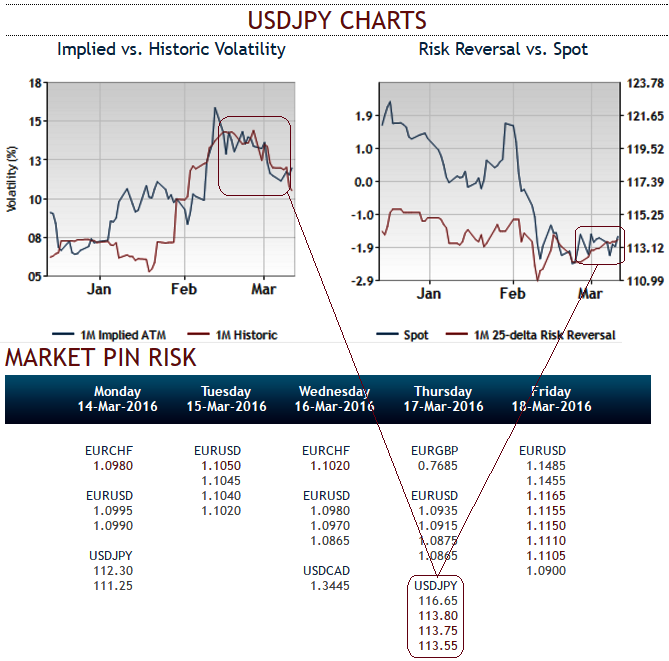

You can probably make out this out how spot and FX OTC market fluctuations moving in sync with each other (see spot FX and risk reversal set up) and so does the IVs and HVs.

We could also observe market pinned risks at 113.800 and below levels, that is the pivot point where a stiff supply is foreseen within next 1 week's time.

However, more downside potential is signalled by risk reversals and in our recent technical indications, it is better to stay hedged for long term investors.

The improving domestic backdrop supports our view that the Fed will continue on with its gradual tightening cycle, so we expect FOMC likely to defer its changes in monetary policy.

After having convinced themselves as recently as a month ago that there was no chance Fed would raise interest rates this year, traders are signalling that at least one is likely before the end of Dec —putting another possible source of volatility back on the agenda.

There is little expectation the Fed will raise rates when it announces its next policy decision on Wed. But the odds of an increase by June have jumped to 43%, and the odds of one by Dec are now 75%, based on the recent price actions of interest-rate futures.

We think current macro situations lead the fed to almost defer policy actions to June meeting, but manipulative statements on monetary policy outcome may keep USDJPY at stake.

FxWirePro: USD/JPY spot and OTC convergence ahead of Fed and BoJ's monetary policy season

Monday, March 14, 2016 8:15 AM UTC

Editor's Picks

- Market Data

Most Popular